FAQ’s on FORM GST PMT 09

What is PMT 09?

PMT 09 is the prescribed challan for shifting the wrongly paid ITC. It is recently introduced by CBIC. If you have paid a wrong tax, like CGST in place of SGST, you can shift it using this challan. It is live on the GST portal. Now you can check its step by step process here.

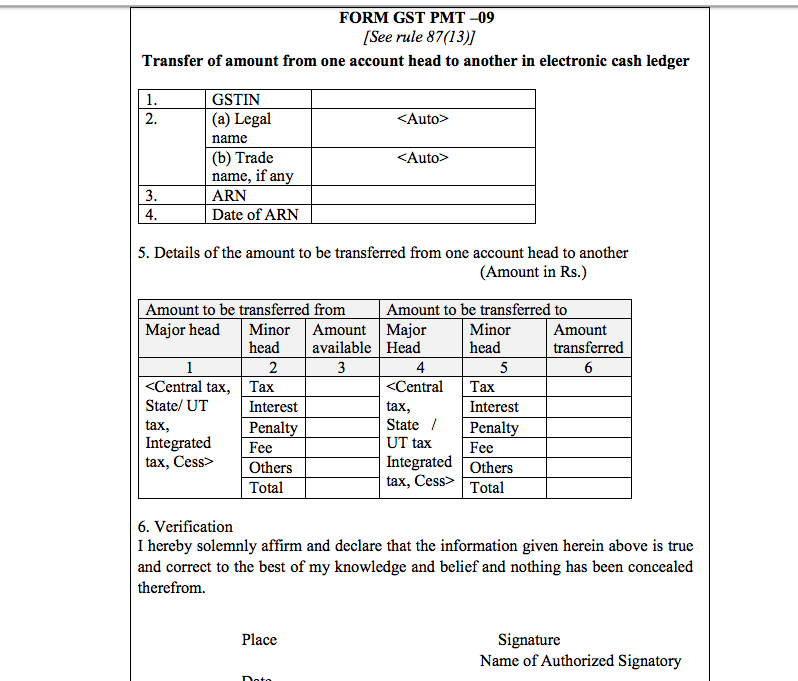

What is the format of PMT 09?

It has minor heads and major heads. You can write your amount of tax you want to shift. This shifting can be from major head to minor head. It can be from one major head to other major head. Following is the format of PMT 09. It is introduced by notification no. 31/2019 CT dated 28th June 2019. Fourth Amendment Act of CGST rules introduced this provision. Clause 13 was added to rule 87 of CGST Rules.

Who can fill a PMT 09?

Every taxpayer can fill PMT 09. It can be accessed via GSTN portal. Once it is live on portal its execution will be discussed.

Thus you can correct your wrongly paid tax easily. One thing we need to take care that in GSTR 3b if a wrong tax is utilized then this challan won’t help. It allows only the shifting of the amount of tax laying in cash ledger. But once the amount is utilized it is removed from cash ledger. In case misreporting in 3b is done, there is again no way out. As we all know editing of GSTR 3b is not possible. We try to remove the errors by making adjustments in next month’s return.

We can say that unless edit facility in 3b is not provided, there is no benefit of this challan. It will be able to handle only one situation and that is when payment is done in the wrong head and not utilized. That situation may arise only in case of penalty etc. Otherwise, we pay prefilled challan generated at the time of filing of return. If the data in return itself is wrong the challan will be wrong but then it will be adjusted too.

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.