No Automatic Refund of IGST of Exports

Stringent Systems Put in Place to Detect Fraudulent Refund Claims by Exporters

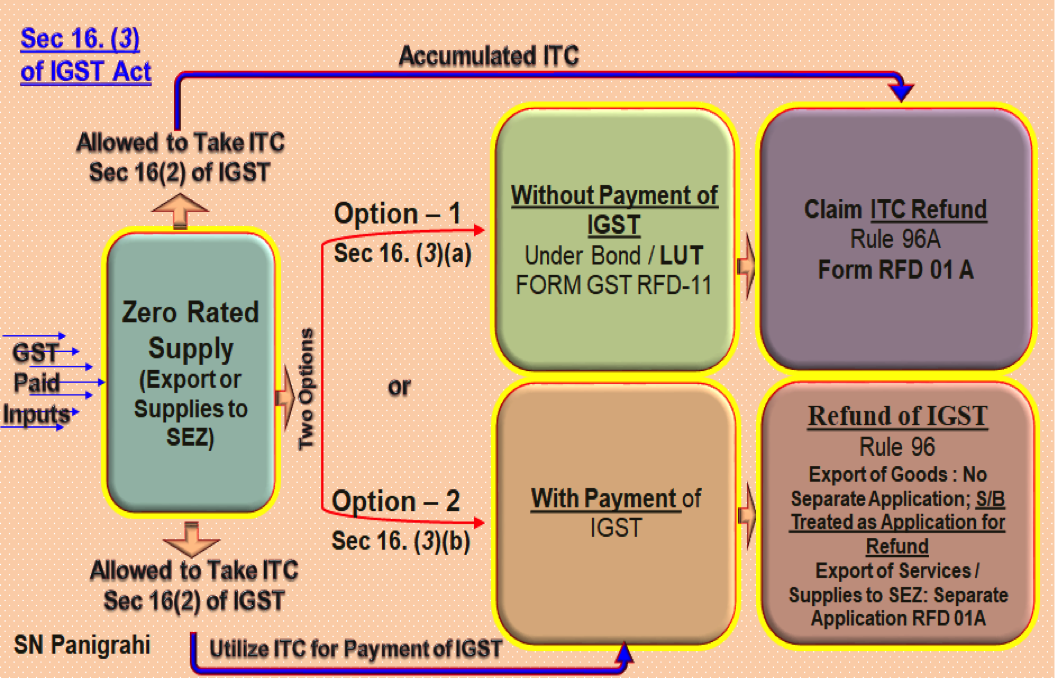

No Automatic Refund of IGST of Exports will be there anymore. As per Sec 16. (3) of IGST Act, Exporters of Goods or Services are allowed to Export under Two Options

- Export Without Payment of GST under Bond / LUT & Claim ITC Refund

- Export On Payment of IGST & Claim Refund of IGST Paid

For Export of Goods Second Option Seems to be Simple and Refund generally is granted very fast mostly within a fortnight Automatically after filling of GSTR -1 & 3B and filling of EGM. Under this Second Option for Export of Goods on Payment of IGST, there is no need to file any separate application. Shipping Bill itself shall be treated as an application. Where as in the First case which is Semi-Automatic, a Separate Application in the Form of RFD – 01A shall be filled online after Exports are made, and Print of such application along with Supporting Documents need to submitted manually to concerned GST officials. Refund is allowed after thorough verification of Documents submitted.

Since the First Option involves certain manual work and personal interface and therefore, proved to be time & money consuming exercise. In the Second Option the procedure for claiming IGST refunds is Fully Automated as provided under Instruction 15/2017-Cus dated 09.10.2017. IT doesn’t involve personnel interferences and is fast clearance of Refunds, so become most Preferred Choice of Exporters.

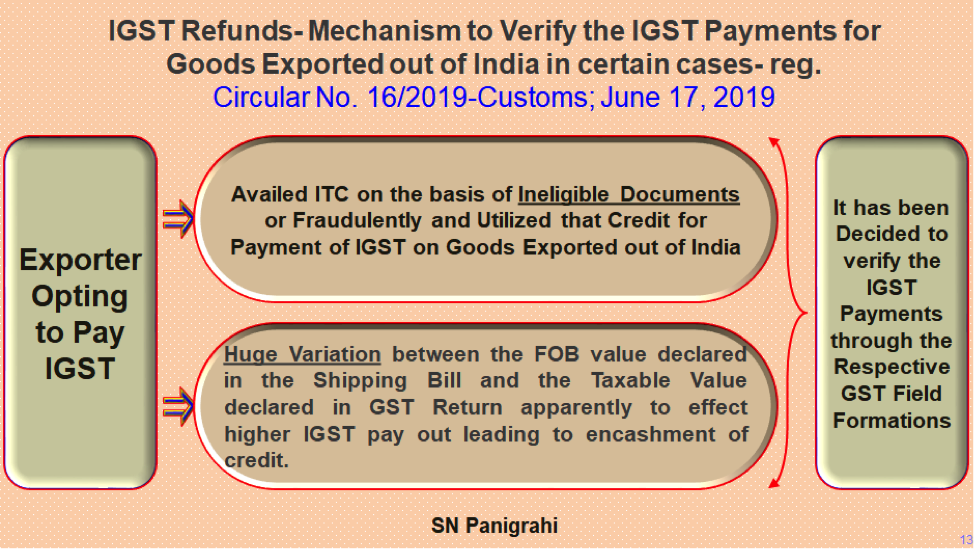

However, off late, it has come to the notice of the Board that instances of availment of IGST refund using fraudulent ITC claims by some exporters have been observed by various authorities.

Exporters have availed ITC on the basis of ineligible documents or fraudulently and utilized that credit for payment of IGST on goods exported out of India. It has also been observed in several cases that there is huge variation between the FOB value declared in the Shipping Bill and the Taxable value declared in GST Return apparently to effect higher IGST pay out leading to encashment of credit.

In view of above, it has been decided to verify the IGST payments through the respective GST field formations. The procedure specified in the instruction 15/2017-Cus dated 09.10.2017 stand modified to the extent as under vide Circular No. 16/2019-Customs; June 17, 2019 :

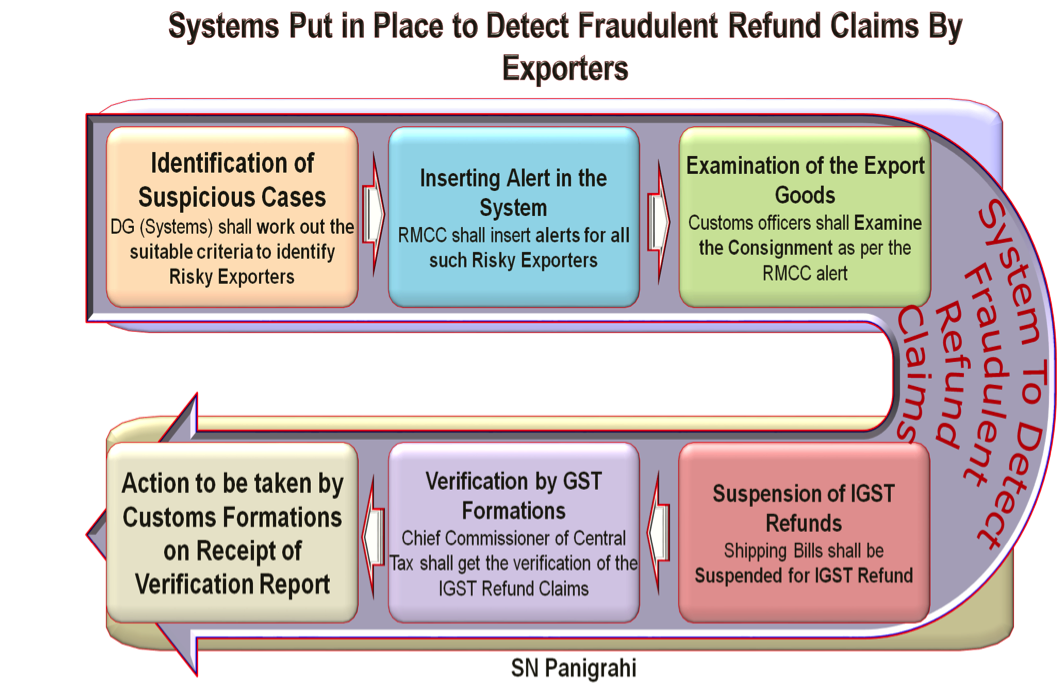

Identification of Suspicious cases:

DG (Systems) shall work out the suitable criteria to identify risky exporters at the national level and forward the list of said risky exporters to Risk Management Centre for Customs (RMCC) and respective Chief Commissioners of Central Tax. DG (Systems) shall inform the respective Chief Commissioner of Central Tax about the past IGST refunds granted to such risky exporters (along with details of bank accounts in which such refund has been disbursed).

- Inserting Alert in the System:RMCC shall insert alerts for all such risky exporters and make 100% examination mandatory of export consignments relating to those risky exporters. Also, alert shall be placed to suspend IGST refunds in such cases.

- Examination of the export goods:Customs officers shall examine the consignment as per the RMCC alert. In case the outcome of examination tallies with the declaration in the Shipping Bill subject to no other violation of any of provision of the Customs Act, 1962 or other laws being observed, the consignment may be cleared as per the regular practice.

- Suspension of IGST refunds:Notwithstanding the clearance of the export consignments as per para C above, such Shipping Bills shall be suspended for IGST refund by the Deputy or Assistant Commissioner of Customs dealing with refund at the port of export.

Verification by GST formations:

- (i) Chief Commissioner of Central Tax shall get the verification of the IGST refund claims and other related aspects done in accordance with the Standard Operating procedure to be issued by the GST policy wing. (ii) The GST formation shall furnish a report to the respective Chief Commissioner of Central Tax within 30 days specifying clearly whether the amount of IGST paid and claimed/ sanctioned as refund was in accordance with the law or not.

(iii) Chief Commissioner of Central Tax shall compile and forward report of all cases to RMCC and concerned customs port of export within 5 working days thereafter.

Action to be taken by customs formations on receipt of verification report from GST formations:

(i) Cases where no malpractices have been reported on verification:

On receipt of verification report from Chief Commissioner of Central Tax informing that the ITC availed by the exporter was in accordance with the GST Law and rules made thereunder, the Customs officer at the port of export shall proceed to process the IGST refund to the extent verified by the GST Authorities. The detailed advisory in this regard shall be issued by DG(Systems) for the benefit of customs officers handling refunds.

(ii) Cases where malpractices have been reported on verification:

For cases where upon verification, it has been found that the exporter has availed ITC fraudulently or on the basis of ineligible documents and utilized the said ITC for payment of IGST claimed as refund, the customs officer will not process the refund claim.

Comments:

Off late there is some relief to the Exporters as the Export Refunds are being cleared very fast, thanks to Automatic Processing of IGST refunds. However, because of some un-scrupulous fraudulent exporters, all the exporters are now put into hardship, that too when Indian Exporters are facing tough times in view of withdrawal of MFN status by US, Non-Tariff Trade war between major economies and slow down of world trade.

Though the criteria to identify risky exporters is not yet clear, all exports shall be scanned closely.

Disclaimer : The views and opinions; thoughts and assumptions; analysis and conclusions expressed in this article are those of the authors and do not necessarily reflect any legal standing.

Can be reached @ snpanigrahi1963@gmail.com