Notes on GSTR-9A is continue. dt.6.5.2019.

Now all the entries that were auto-filled in relevant fields of different tables of Form GSTR-9A, based on filed Form GSTR-4, would be auto-populated in the respective sheets in the Offline tool. Next, you need to add or edit table –wise details in the worksheet, which is explained below:

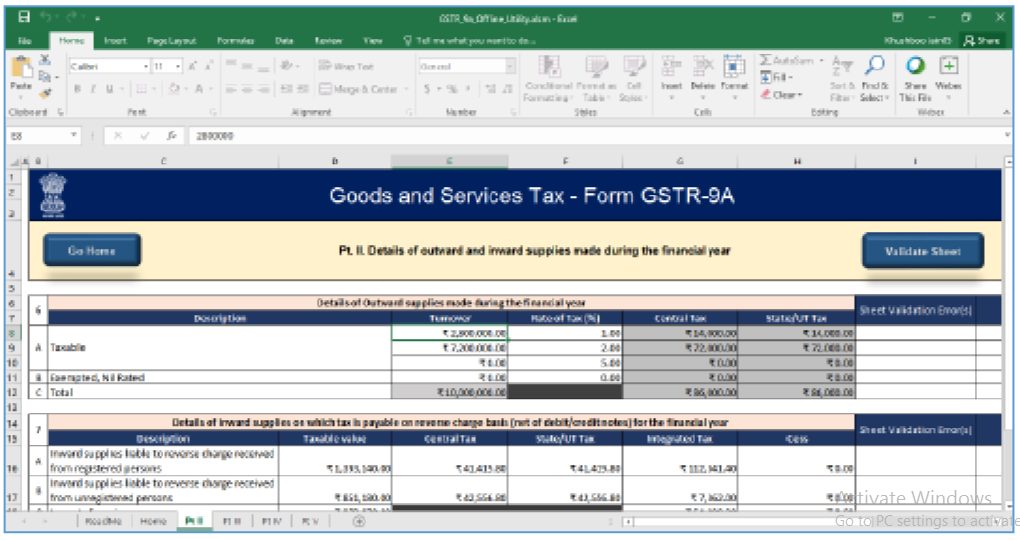

Picture 18

- Add table –wise details in the worksheet:

- For preparing details in Offline Utility you have two options:

- Either download the utility from GST portal and fill up required details, create JSON File and then upload on the GST Portal, OR

- Download the JSON file from the Portal containing system computed details of Form GSTR-9A and import it/ open it into the offline tool and then edit it. All the entries will be editable except tax paid in Table 9 which will be prefilled and non-enterable.

- To add table-wise details of Outward supplies made during the financial year, details of inward supplies on which tax is payable on Reverse Charge Mechanism (RCM)basis (Net of debit/credit notes) for the financial year and details of other inward supplies for the financial year.

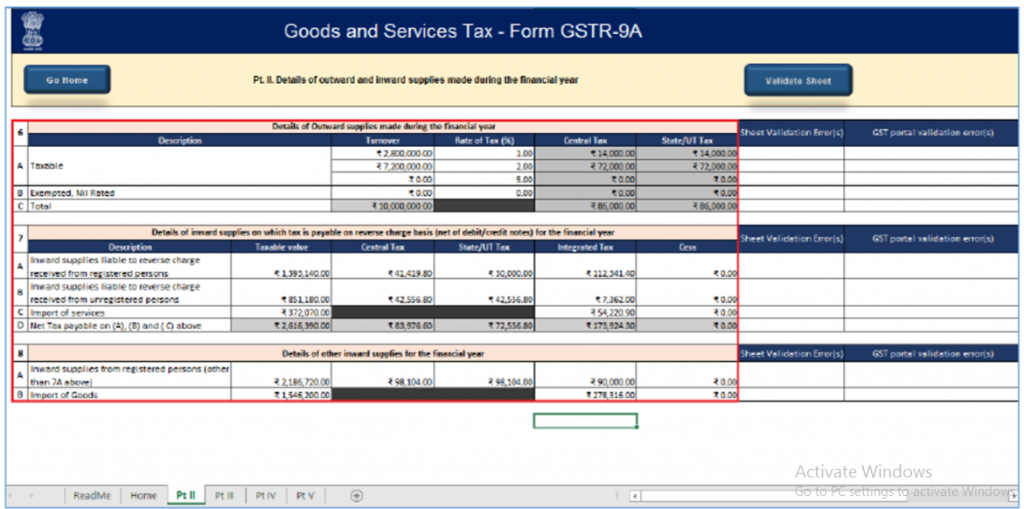

- Refer to picture No. 19.

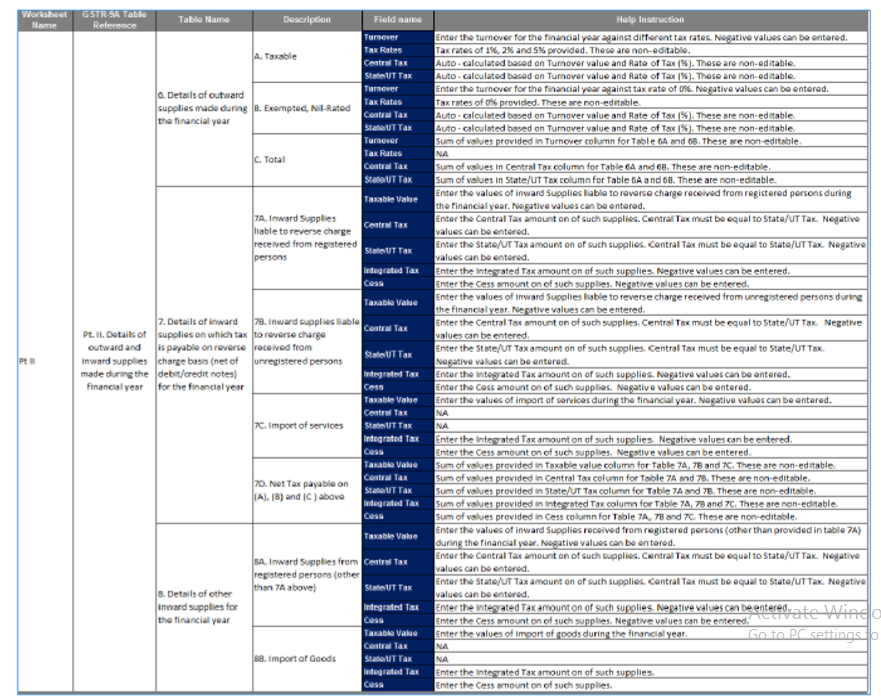

Note: The table below provides the worksheet name, table name and detailed description for this sheet.

Picture.20

It has been noted that this table seeks the details of “all taxable, exempted, Nil-rated and Non – GST supplies. However, the details of taxable outward supplies are reported in GSTR-4. Accordingly, for the purpose of GSTR-9A, the details have to be segregated between the taxable, exempted portion of the outward supplies.

In Table No.6A:

These following details to be entered:-

(a). The aggregate value of all outward supplies,

(b). Outward supplies shall be net of debit notes/credit notes, (These details are to be declared as net of credit notes or debit notes issued in this regard.

(c). Outward supplies shall be net of advances (Please refer the below notes on GST liability on advances)and,

(d). Outward supplies shall be net of goods returned for the entire financial year shall be declared here.

Note on GST discharge on advance received against a supply of goods: The requirement to pay GST on advances received in respect of goods has been dispensed for all the taxpayers (excluding Composition supplier) on the recommendation of 23rd GST Council Meeting held on 10th November,2017-Notification No.66/2017-Central Tax-dated.15th November 2017. Earlier, GST Council vides its 22nd meeting held on 6th October 2017, Notification No.40/2017-Central Tax-dated.13th October 2017 has decided that taxpayers having an annual aggregate turnover up to Rs.1.5 Crores shall not be required to pay GST at the time of receipt of advances on account of supply of goods.

Now the same has been extended to all the taxpayers but excluding “COMPOSITION SUPPLIER”. Hence, it needs to be ensured that the GST needs to be paid on the advances received by the Composition Supplier as per “Time of Supply stipulated in section 12(2) of CGST Act,2017. Dear Colleagues, in my knowledge in India most of the Compositions Suppliers are not discharged GST on advances received against the supply of goods. So, kindly take more concentration on this area.

Interlink with GST RETURNS:

Table 6 of GSTR-4: The details of the outward supply made by the Composite Supplier made in Table 6 of GSTR-4 is required to be reported in Table 6A of GSTR-9A. The details of outward supplies reported in the table 6of GSTR-4 is net of advances received and goods returned during the quarter. Advance received against the supply of goods is also part aggregate turnover as it is a consideration for a supply.

Rate of Tax applicable to “Composition Supplier:

The rates have been prescribed under Rule 7 of the CGST Rules as mentioned below:

- @1% of the turnover in State or turnover in Union Territory in case of Manufacturers. However,@0.5% of the turnover in State or Union Territory shall be levied as per the recommendation of the 23rd GST Council Meeting held on 10th November,2017-vide Notification No.1/2018-Central Tax Rate-dated.1st January 2018 w.e.f. 01.01.2018. Further amended vide Notification No.3/2018 –Central Tax.dated.23rd January 2018 w.e.f. 1st Jan 2018, in order to keep a uniform rate of tax for both “TRADERS and MANUFACTURERS. Further, it must be noted that Total Turnover (Taxable and Exempted Turnover).

- (ii) 0.5% of the turnover in State or turnover in Union Territory in case of another supplier eligible for composition levy (generally Traders). However, it must be noted that the tax shall be calculated only on the taxable turnover as per the recommendation of the 23rd GST Council Meeting held on 10th November 2017 vide Notification No.1/2018-Central Tax Ratedated.1st January 2018 w.e.f. 01.01.2018. Further amended vide Notification No.3/2018 – Central Tax.dated.23rd January 2018 w.e.f. 1st Jan 2018.

- @2.5% of the turnover in State or Union Territory in case of persons engaged in making supplies referred to Paragraph 6(b) of Schedule II, vide Notification No.3/2018-Central TaxDated,23rd January 2018. W.e.f. 1.1.2018.

The said paragraph states that the composite supply shall be treated as “supply of service” where the supply, by way of or as a part of any service or in any other manner whatsoever, of goods, being food or any other article for human consumption or any drink (other than alcoholic liquor for human consumption), where supply or service is for cash, deferred payment r other valuable consideration.

In Table No.6B: These following details to be entered:- In this table, you have to enter the following details to be included.

(a). The aggregate value of exempted, NIL Rated and NON-GST supplies shall be mentioned.

(b). As per section 10(2) of the CGST Act,2017, a registered person who makes any supply of goods which are not leviable to tax under GST will straight away sweep out of the composition scheme, For Example, Petroleum, Alcohol for human consumption, etc.,

(c). As per section 2(47) of CGST Act,2017, Exempted supply means the supply of goods and/or services which attract NIL rate of tax or which may be WHOLLY EXEMPT FROM TAX UNDER SECTION 11 or Under Section 6 of IGST Act,2017 and includes which non-taxable supply. The definition of exempt supply has “ THREE LIMBS”. The inclusive part clearly states that exempt supply means a supply of non-taxable supplies also.

Notes on GSTR-9A is to be continued——- dt.6.5.2019.

B S Seethapathi Rao

B S Seethapathi Rao

East Godavari, India