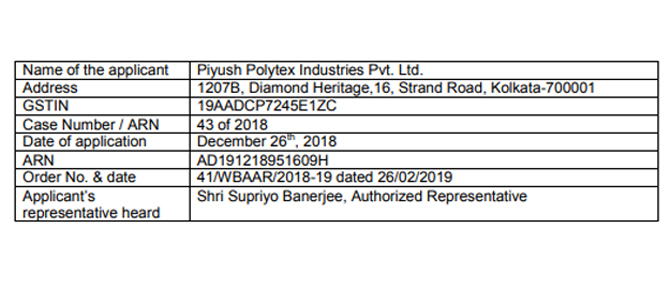

Original copy of GST AAR – Piyush Polytex

Download the full pdf of GST AAR – Piyush Polytex by clicking the image below

1. Admissibility of the Application

1.1 The Applicant, stated to be a manufacturer of P.P. Nonwoven Fabric, Laminated Nonwoven Fabric, B.O.P.P. Pasted P.P. Nonwoven Fabric, P.P. Woven Fabric Pasted with Nonwoven Fabric and Nonwoven Bags/Sacks, seeks a Ruling on description & HSN of Bags/Sacks (both with & without Handle) made of (i) Laminated P.P. Nonwoven Fabric, (ii) B.O.P.P. Pasted P.P. Nonwoven Fabric and (iii) Woven Fabric Pasted with Nonwoven Fabric, under the GST Act.

1.1 Advance Ruling is admissible under Section 97(2)(a) of the GST Act.

1.3 The Applicant submits that the question raised in the Application has neither been decided by nor is pending before any authority under any provisions of the GST Act.

1.4 The officer concerned raises no objection to the admission of the Application.

1.5 The Application is, therefore, admitted.

2. Submissions of the Applicant

2.1 The Applicant in Annexure-I of the Application discusses probable classification of different types of fabrics manufactured by them, but remains silent on the description & HSN of Bags/Sacks, on which the Ruling is sought. The Applicant only states that nonwoven bags/sacks are made of P.P. Nonwoven Fabric and it falls under Chapter Heading 63 of the GST Tariff. In this regard the Applicant relies upon AAR Order No. CT/5492/18-C3 dated 29/05/2018 passed by the Authority for Advance Ruling, Kerala.

3. Submissions of the Revenue

3.1 With reference to Question no. (i) & (ii), on which Advance Ruling is sought, Revenue mentions that Circular No. 80/54/2018-TRU dated 31/12/2018 clarifies the matter in Para-7 and states in Para-7.4 that “thus it is clarified that Polypropylene Woven and Non-Woven Bags and PP Woven and Non-Woven Bags laminated with BOPP would be classified as plastic bags under HS code 3923 and would attract 18% GST”. Further, in relation to the question no. (iii) regarding description & HSN, if Bags/Sacks are made of Woven Fabric pasted with Nonwoven Fabric (with Handle & without Handle), Revenue refers to notification No. 01/2017-Central Tax (Rate) dated 28/06/2017.

4. Observation & Finding of the Authority

4.1. Since the Applicant seeks a Ruling on description & HSN i.e. classification of Bags/ Sacks only and not classification of fabrics, manufactured by them, this Authority confines the discussion on Bags/Sacks only.

4.2. In the cited AAR Order No. CT/5492/18-C3 dated 29/05/2018, the Authority for Advance Ruling, Kerala decided classification & rate of tax of carry bags made of P.P. Nonwoven fabrics under Chapter 63, taxable @ 5%, as in entry 224 of Schedule 1 of the Notification No. 01/2017- CT (Rate) dated 28/06/2017. Here, the relevant portion of Tariff item 6305 33 00 under the GST Tariff is also mentioned, which covers sacks and bags, of a kind used for packing of goods, made of man-made textile materials which are not flexible intermediate bulk containers but are of polyethylene or polypropylene strip or the like.

4.3. However, TRU clarification under Circular No. 80/54/2018-GST issued under F. No. 354/432/ 2018-TRU dated 31/12/2018 in Para 7, sub-Para 7.4 clarifies that Polypropylene woven and nonwoven bags and PP woven and non-woven bags laminated with BOPP would be classified as plastic bags under HS Code 3923 and would attract 18% GST; and in Para 7, sub-Para 7.5 clarifies that non-laminated woven bags would be classified as per their constituting materials. Whether the bag/sack has handle or not, is of no consequence here.

4.4. HS Code 3923 covers articles of the conveyance or packing of goods, of plastics; etc. SubHeading 39232990 is applicable for sacks and bags of plastics which are neither polymers of ethylene nor of poly-vinyl chloride and are subject to 18% GST.

4.5. Regarding Bags/Sacks made of Woven Fabric Pasted with Nonwoven Fabric the Applicant has not stated the constituting materials of the fabric and hence, in the absence of any definite material mentioned for the fabric, the General Rules for the Interpretation of the First Schedule of the Customs Tariff, which has been adopted by GST have to be referred to.

In view of the foregoing, we rule as under:

RULING

(i) Bags/Sacks (both with & without Handle) made of Laminated P.P. Nonwoven Fabric is classifiable under Sub-Heading 39232990,

(ii) Bags/Sacks (both with & without Handle) made of B.O.P.P. Pasted P.P. Nonwoven Fabric is classifiable under Sub-Heading 39232990, and

(iii) Bags/Sacks (both with & without Handle) made of Woven Fabric Pasted with Nonwoven Fabric have to be classified as per the General Rules for the Interpretation of the First Schedule of the Customs Tariff .

This Ruling is valid subject to the provisions under Section 103 until and unless declared void under Section 104(1) of the GST Act.

| (SYDNEY D‟SILVA) | (PARTHASARATHI DEY) |

| Member | Member |

| West Bengal Authority for Advance Ruling | West Bengal Authority for Advance Ruling |

Reference

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.