Entry Tax on Import of Goods

Entry Tax on Import of Goods – What you should know?

Have you also received a notice for entry tax on import of goods?The Govts have started flooding the dealers with series notices over Entry Tax liability where goods were brought into the states from out of India. What are the legal provisions behind these notices and what has changed just now, one should know. In this write up, we are trying to explain this issue in the light of Rajasthan Entry of Goods into Local Areas Act, 1999.

What is Entry tax?

It is a levy of tax in cases where the goods are brought into the local area (i.e. in the state) from outside the local area. It taxes the goods when they enter in the state. All goods which are brought into the local area from outside the local area for the purpose of consumption, use or sale within the state are being taxed under these provisions.

It is essentially a tax levied on all the goods which are brought in the state from outside the state for the purpose of sale, consumption and use in the state.

What is the issue related to imports?

In case of imports, however the material is bought from outside the state into state, it was contended that it do not fulfil the following criteria:-

- That material was not brought from any other state into the state, whereas the Entry tax law required hat movement should have occasioned from any other state, which is not the case.

- That the import materialises directly in the state at the business premise of the person importing it, thus it is also not the case where the material is “brought into”. It was said that occasioned in the state only. Thus not a case of Entry Tax.

However, the Hon’ble Supreme Court in a rejected the above contentions and upheld the view of the departments of various states that the Entry tax is leviable on all the goods imported into the local area for the purpose of sale, use or consumption within the state.

When they can be taxed?

It is not necessary always that the Entry tax will be levied in each case where the goods are imported. There are certain exemptions and situations where the goods can be taken out of this levy of Entry Tax. Such cases are:-

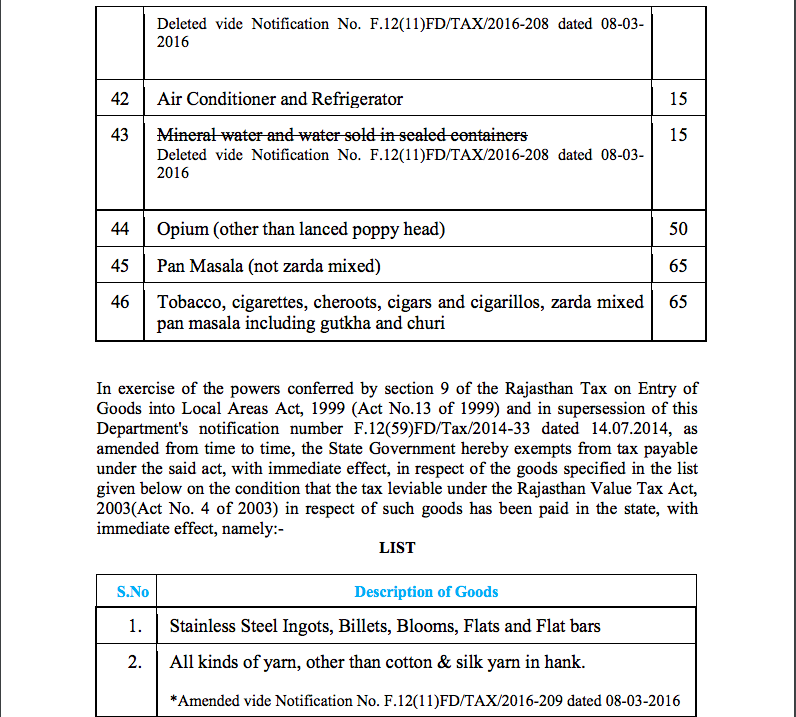

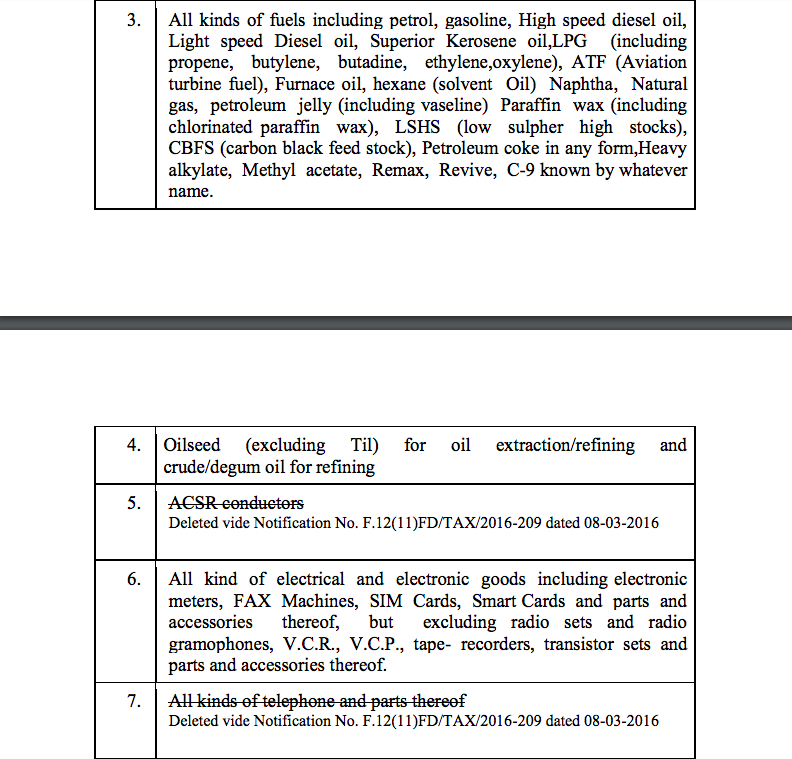

- Goods are sold in the state as such and VAT is paid on those goods in the state

- Goods are not sold within the state I.e. sold outside the state

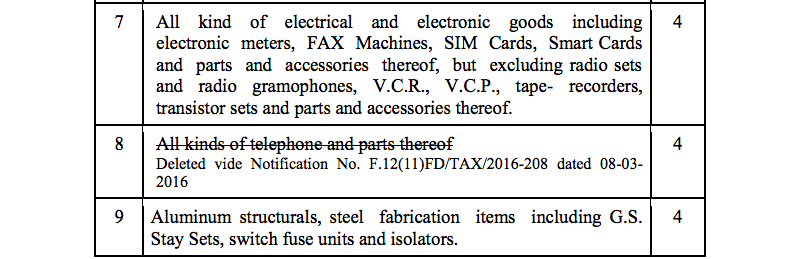

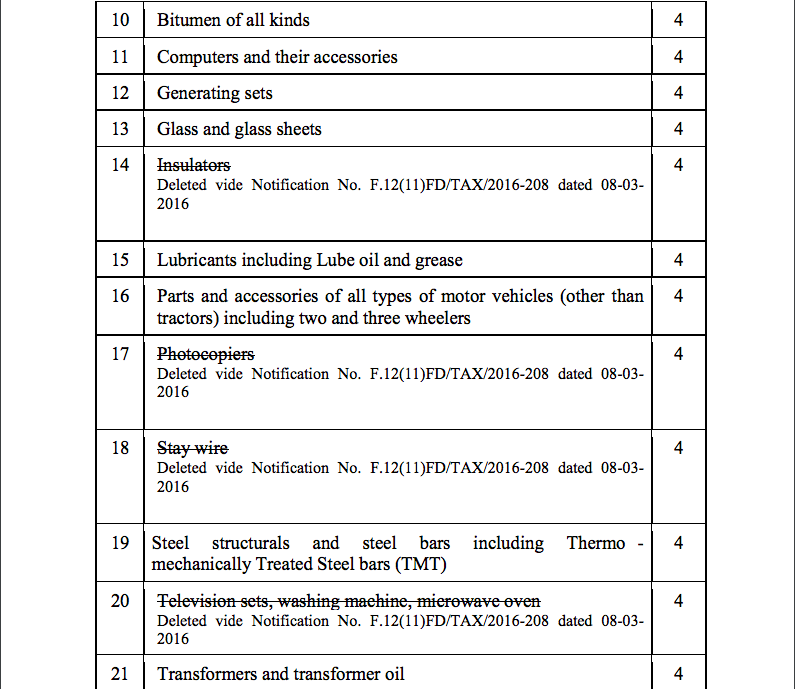

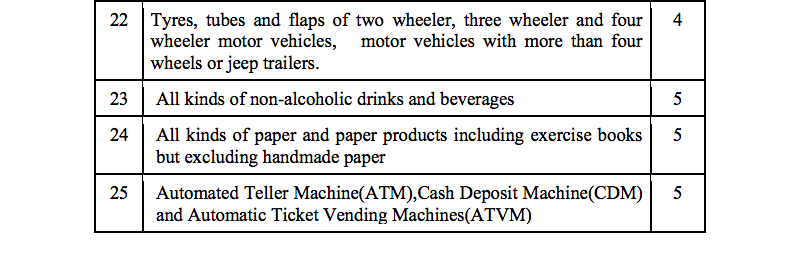

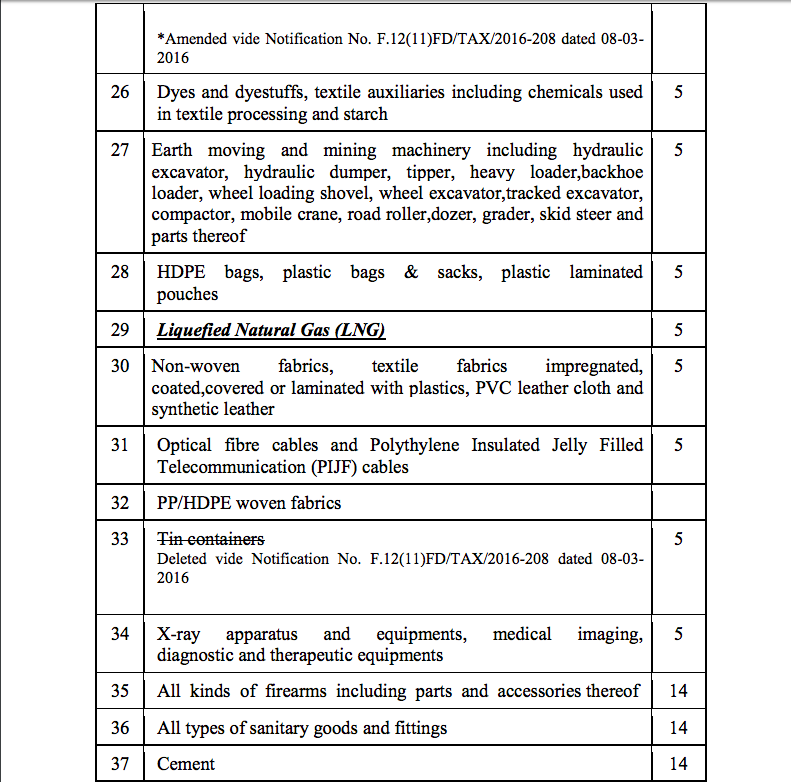

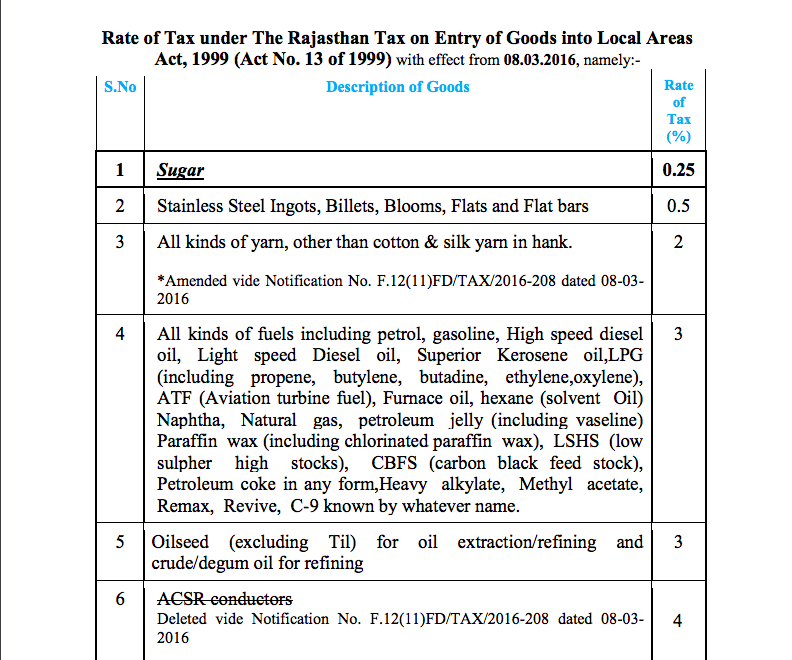

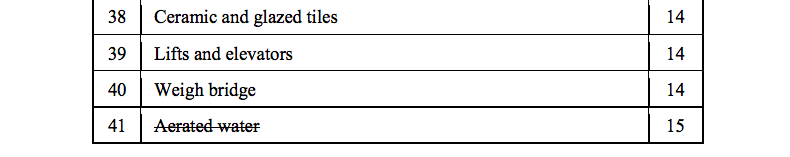

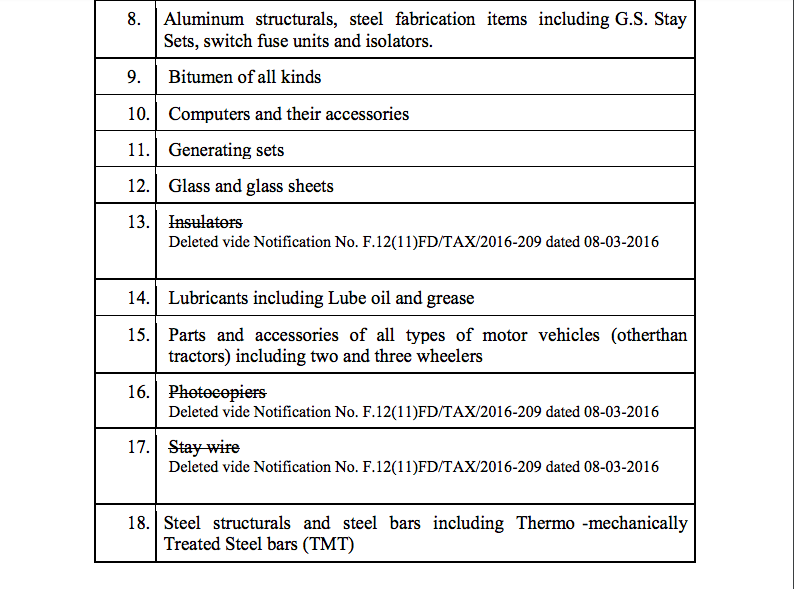

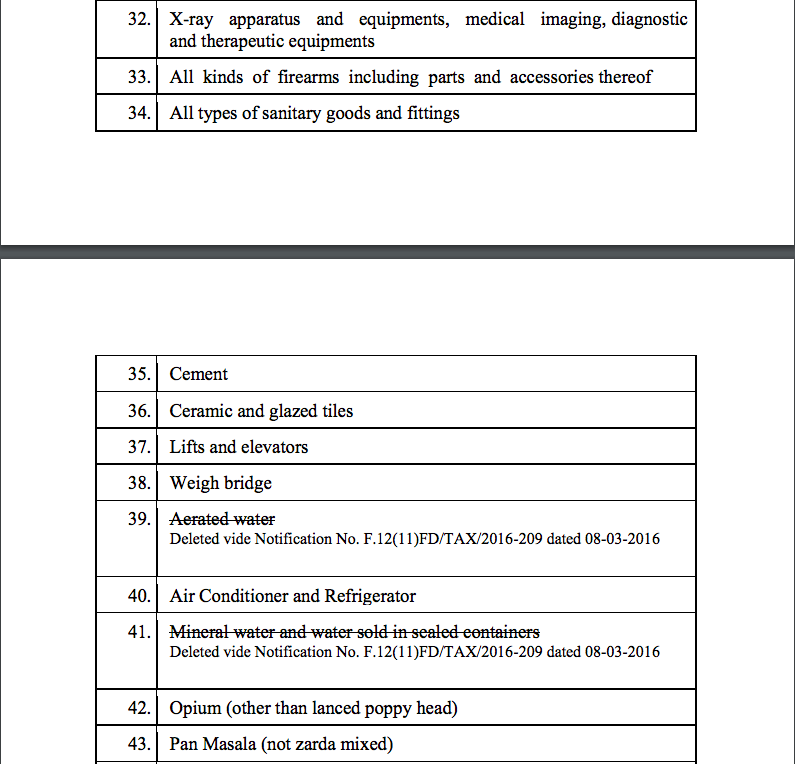

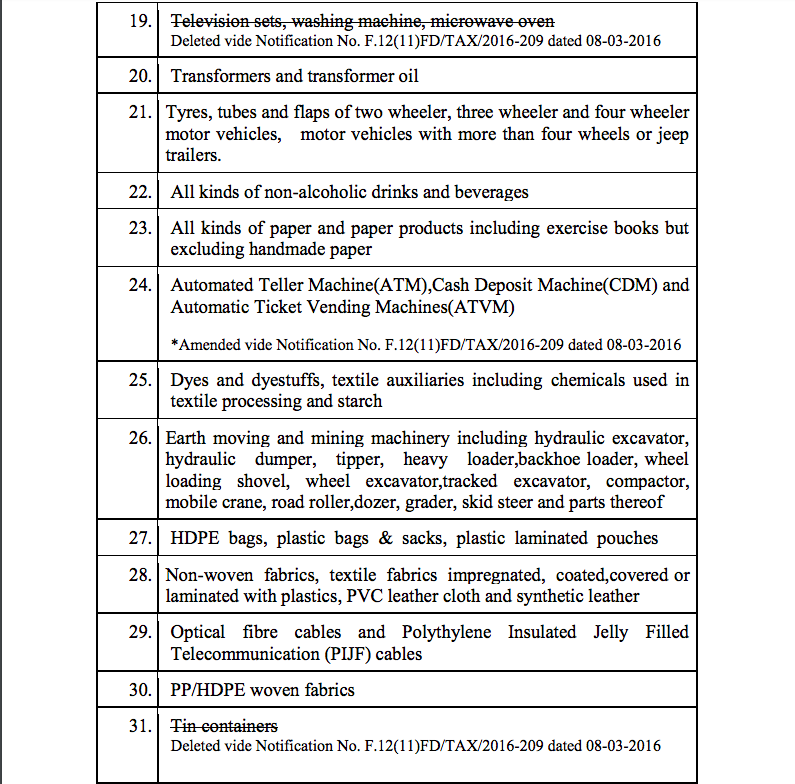

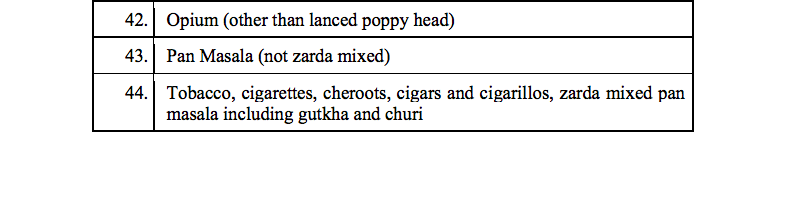

- Goods do not fall under the category of entry tax goods i.e. there are only 53 items in the state of Rajasthan on which the entry tax is levied. Rest all the items are out of this category. Dealer can fight for exclusion of his item from a particular category on case to case basis.

Entry Tax on Import of Goods

Entry Tax on Import of Goods

- Goods are used in a works contract where the property in the goods have been transferred to the buyer.

The period for which the department can ask for Entry tax?

As on 31.03.2019, where the department had issued the notice of entry tax, the department had the right to issue notices for the financial year 2013-14 not before that (i.e. within 5 years from the end of the FY). Thus, all the periods could be opened from FY 2013-14 till 30.06.3017 (afterwards the entry tax was subsumed in GST).

What should a dealer do in case a notice of Entry tax is received?

- See whether the notice is before FY 2013-14.

- See whether the details asked correspond to his imports.

- See whether his goods confirm to the list of goods on which Entry tax is leviable?

- To see whether he falls to any of the exceptions or exemptions to entry tax law?

- Finally file the reply to the department taking resort to the details and information available.

Related Topic:

C Form Under GST Scenario [Updated Information]

In the end, we would conclude that though levy of Entry Tax has been upheld in case of imported goods by the Supreme Court, still the assessee has a lot of space to see and cast out his goods from such levy and save themselves. One need a cautious look at various imports made by him and there eligibility for Entry Tax.

CA Ranjan Mehta

CA Ranjan Mehta

CA Ranjan Mehta is a Fellow Chartered Accountant of Institute of Chartered Accountants of India and currently proprietor of M/s Ranjan Mehta & Associates. His area of specialization includes Indirect taxes specially GST, Excise, VAT and Service Tax. He is a faculty for GST. He has presented more than 100 papers on GST at various levels of ICAI, trade bodies, corporate seminars.