Reasons to believe for GST search

Reasons to believe is required for search & Seizure: HC:

Reasons to believe is very important for any search and seizure.It is important to have a reason to believe to record.

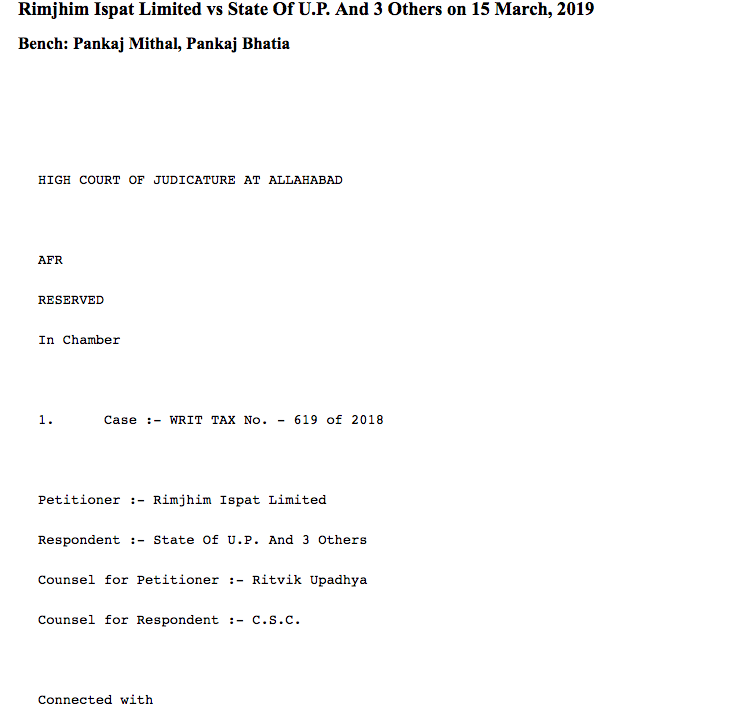

Case: Rimjhim Ispat Limited vs State Of U.P. And 3 Others on 15 March, 2019.

It is a landmark decision for the current practice of search and seizure in GST.It Section 67 of CGST Act provide for the inspection, search and seizure. But this power can be excercised only when there is a reason to believe.It is also argued that the ‘reasons to believe’ should be based upon tangible material and should not be based upon fanciful consideration as the exercise of powers of search and seizure is an exception to the fundamental right of the petitioner guaranteed under Article 19(1)(g) of the Constitution of India and this should be exercised strictly within the parameter prescribed for its exercises as any violation thereof would negate the rights of the petitioner guaranteed under Article 19 of the Constitution of India.

reasons to believe

Relief requested by the petitioner:

The petitioner, thus, prays for the following reliefs:

(i) issue a suitable writ, order or direction in the nature of certiorari calling for the records of the case and to quash the impugned Seizure Order and Panchnama dated 14.3.2018 (Annexure-1 to this writ petition).

(ii) issue a suitable writ, order or direction in the nature of mandamus restraining the respondents from taking any action on the basis of the impugned Seizure Order and Panchnama dated 14.3.2018 (Annexure-1 to this writ petition.)

(iii) issue a suitable writ, order or direction in the nature of mandamus commanding the respondents to release/return all the documents and goods seized vide the impugned Seizure Order and Panchnama dated 14.3.2018.

(iv) issue a suitable writ order or direction in the nature of mandamus directing the respondents, to return back the sale and purchase invoices which are yet to be incorporated in the stock register, seized during the course of search, to find out actual figure of purchases and sales.

(v) issue any other writ, order or direction which this Hon’ble Court may deem fit and proper in facts of the instant case.

Observation:

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.