New returns of GST mandatory from 1st July

New returns of GST mandatory from 1st July:

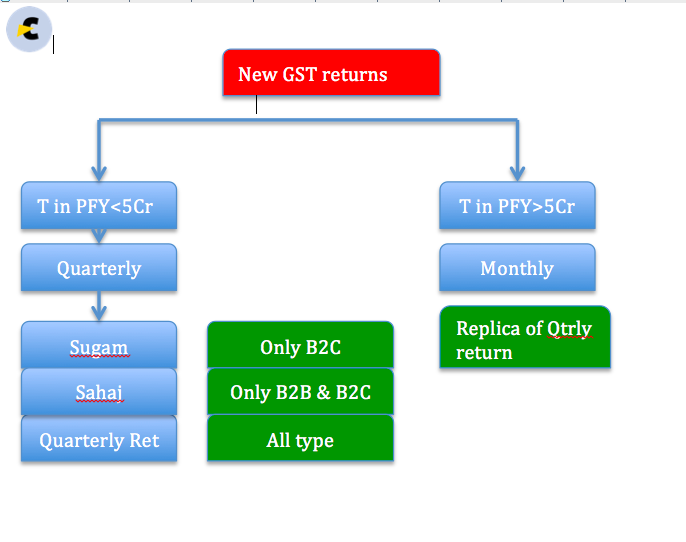

Basic scheme of new returns of GST:

Have you seen the new returns of GST. They are named as Sahaj and Sugam. Honestly when I try to understand them. I found it that they are one of the most difficult things in entire GST. Even a long Supreme Court decision will not take that much of efforts. There were some risky zones and I don’t know how we will manage once they will be live. Let me brief a little about their structure.

Basic scheme of returns in new regime:

There are three returns for quarterly filing and one return for monthly filing. Remember tax payment will be monthly in all cases.

New returns of GST from 1 july 2019

Comparison of all three schemes:

|

|

|

Sugam |

Sahaj |

Qtrly |

|

1. |

Supply Covered |

B2C B2B |

B2C |

All type of outward supplies |

|

2. |

Who can File |

TO<5Cr |

TO<5Cr |

TO<5Cr |

|

3. |

Self Declaration |

RCM only |

RCM only |

All purchases |

|

4. |

Frequency |

Quarterly |

Qtrly |

Quarterly |

|

5. |

ITC |

Only uploaded by Supplier +RCM |

Only uploaded by supplier +RCM |

All invoices including missing invoices. |

|

5. |

How ITC will be available |

Invoices uploaded by supplier upto 10th will be available at the time of filing relevant return |

Same |

Same |

|

6. |

Can show export TO |

No |

No |

Yes |

|

7. |

Can show SEZ turnover |

No |

No |

Yes |

Who will be eligible to file GST Sugam in New GST return scheme?

The following taxpayers will be eligible for GST Sugam.

- Taxpayers having B2B and B2C outward supplies.

- Person don’t have Export, SEZ Supplies and any supply via an e-commerce portal.

- Taxpayers No registered as an ISD.

- Composition dealer is not eligible for this scheme.

- Amendment will also be possible via this return

Who will be eligible to file GST Sahaj in New GST return scheme?

The following taxpayers will be eligible for GST Sugam.

- Taxpayers having B2C outward supplies only.

- Taxpayersdon’t have Export, SEZ Supplies and any supply via an e-commerce portal.

- Taxpayers No registered as an ISD.

- Taxpayers not opted for any composition scheme of GST.

- Amendments will also be possible via this return.

What is benefit of filing GST Sugam in New returns of GST

It is simplified. The return will need to be filled for outward supplies and inward supplies covered in RCM only. It can be filled quarterly. The tax payment will be monthly via GST PMT 08. There is no need to fill HSN codes for supply or inward supply.

What is benefit of filing GST SahaJ in New GST return scheme?

Sahaj is simplified return. No need to give details of purchase. Only the RCM purchase and B2C supply is required to be entered in this return. There is no requirement to enter the HSN codes for supply or for purchase.

Who can file Qtrly return in New GST return scheme?

Quarterly return can be file by a taxpayer having turnover of less than Rs. 5 Crores. The taxpayers not eligible for GSTR Sugam and Sahaj will have to opt for this return. It is worthwhile to mention that if there is any supply other than B2B and B2B this will be mandatory. Export, SEZ supplies, Deemed Export and E commerce supplies can be filed only via quarterly return.

What can be included in Qtrly return in New GST return scheme?

All of the following supplies can be reported via quarterly return.

- B2B supply.

- B2C supply.

- Export with payment of IGST.

- Export without payment of IGST.

- SEZ supplies.

- Deemed Exports.

- No need to entre HSN codes except the import/ export transactions.

Following inward supplies can also be reported.

- RCM inward.

- Normal inward.

- Import of goods.

- Import of services.

- Missing invoices to take ITC.

The bills missed in earlier returns can also be shown in this return. Amendments can also be done via this return.

Who will file the monthly return in New GST return scheme?

Taxpayers having the turnover of more than Rs. 5 crore will have to file monthly return. The patters of return will be same as of quarterly return. It will be a full-fledged return. All details will be required to be filled. The taxpayer will have to fill HSN up to 6 digits for all supplies. They will be able to self claim the ITC for missing invoices.

What can be included in GST monthly return in New returns of GST?

All the date related to supply and inward supplies can be included in this return.

How we can show old missing invoice in Sugam , Sahaj , Qtrly or monthly return in New returns of GST?

There can be three scenarios. Details of documents of the period prior to introduction of the current return filing system can also be uploaded in the relevant tables of this annexure. Only those details shall be uploaded which have not been included in the erstwhile FORM GSTR-1. All supplies that are declared in this annexure will be accounted for payment of tax.

Following scenarios may happen:

(i) Document has not been reported in FORM GSTR-1 and tax has also not been

accounted for in FORM GSTR-3B – In this case, document shall be uploaded

and tax shall also be paid along with applicable interest except in case of

issuance of credit notes.

(ii) Document has not been reported in FORM GSTR-1 but tax has been accounted for in FORM GSTR-3B– In this case, document shall be uploaded and

adjustment of tax accounted for shall be made in table 3C(5) of FORM GST

RET-1, but in case of issuance of credit notes, upward adjustment shall be

made in table 3A(8) of FORM GST RET-1.

(iii) Document has been reported in FORM GSTR-1 but tax has not been accounted for in FORM GSTR-3B – In this case, uploading of the document shall not be required but adjustment of tax shall be made in table 3A(8) or 3C(5) of FORM GST RET-1, as the case may be.

What are the issues in new returns of GST?

Fillers of Sugam and Sahaj Cant take ITC of missing invoices. This is going to hit them hard. Most of the users will then chose for GSTR Quarterly. This will fail the basic purpose for introduction of GSTR Sugam and GSTR Sahaj at the first place.

How the editing and amendment of new documents will be possible in new GST returns.

- Editing of documents upto the 10th of the following month – Details of the documents uploaded upto the 10th of the following month may be edited by the supplier upto the said date (10th of the following month) only if such documents are not accepted by the recipient. If a document has already been accepted (upto the 10th) by the recipient, then such document has to be reset / unlocked by the recipient and only then, it can be edited by the supplier upto the 10th of the following month. Following two scenarios may arise:

(i) In case, the recipient files his return on monthly basis, all the documents uploaded by any supplier [irrespective of the fact whether the supplier files his return on monthly or quarterly (Normal, Sahaj or Sugam) basis] shall be available for acceptance by such recipient upto the 10th of the month following the month for which the return is being filed. The supplier can edit the documents so accepted by the recipient only if the same are reset/unlocked by the recipient by the said date.

(ii) In case, the recipient files his return on quarterly (Normal, Sahaj or Sugam) basis, all the documents uploaded by any supplier [irrespective of the fact whether the supplier files his return on monthly or quarterly (Normal, Sahaj or Sugam) basis] shall be available for acceptance by such recipient upto the 10 th of the month following the quarter for which the return is being filed. The supplier can edit the documents so accepted by the recipient only if the same are re-set/unlocked by the recipient by the said date.

Supplier side Amendment –

- The return system provides for all editing or amendments from the supplier’s side only. The recipient will have the option to reset / un-lock or reject a document but editing of or amendment to the same shall be made by the supplier only.

- Edit / Amendment after 10th of the following month -The details of the documents uploaded by the supplier upto the 10th of the month following the month or quarter for which the return is being filed for will be auto-populated and made available to the recipient in FORM GST ANX-2 to accept, reject or to keep the document pending.

- Instructions regarding acceptance, rejection or kept pending by the recipient may be referred to in the instructions to FORM GST ANX-2.

- Documents rejected by the recipient shall be conveyed to the supplier only after filing of the return by the recipient.

- The rejected documents may be edited before filing any subsequent return for any month or quarter by the supplier. However, credit in respect of the document so edited or uploaded shall be made available through the next open FORM GST ANX-2 for the recipient. However, the liability for such edited documents will be accounted for in the tax period (month or quarter) in which the documents have been uploaded by the supplier.

Shifting of Documents –

- In certain situations, the particulars of the document may be correct but the document has been reported in the wrong table. Therefore, when such documents are rejected by the recipient, instead of amending the document, a facility of shifting such documents to the appropriate table will be provided.

8. Amendment of documents relating to supplies made to persons other than persons filing return in FORM GST RET-1/2/3(e.g. supplies made to composition taxpayers, ISD, UIN holders etc.) – The documents relating to such supplies may be amended by the supplier at any time and the same shall not be dependent upon the action taken (accept/reject/pending) by the recipient

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.