GST will not be levied on TCS: CBIC clarification

GST will not be levied on TCS: CBIC clarification:

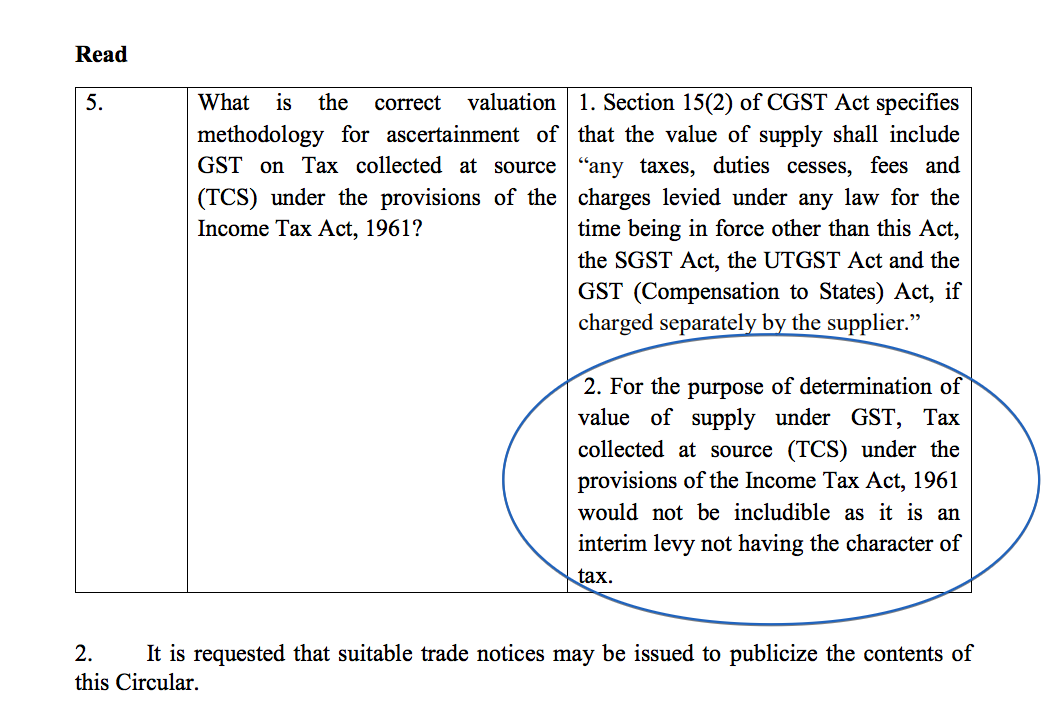

GST will not be levied on TCS.Corrigendum to Circular No. 76/50/2018-GST dated 31st December, 2018 issued vide F.No. CBEC- 20/16/04/2018-GST- Reg. The corrigendum edited its entry no.5 which covered the valuation for GST. This entry earlier mentioned that TCS deducted under income tax Act will be covered in value. A case against this was filed in High court and this circular was put on hold. In case of PSN automobiles ltd. it was decided by High It was very well explained by the counsel that section 15 covers the taxes levied and TCS is not a levy of tax. The tax is levied by Income Tax Act itself and TCS is just an advance payment of the same.

Now the CBIC corrected the mistake and excluded the TCS from the valuation u/s 15 of CGST Act. This issue was widely opposed by industry. Income Tax Act also added GST to calculate TCS. Both included each other. It posed a problem for industry regarding its calculation and presentation in Invoice. Now all those issues are resolved by CBIC. It will be a big relief for all taxpayers.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.