Original Copy GST AAR of GGL HOTEL AND RESORT COMPANY LIMITED

Original Copy GST AAR of GGL HOTEL AND RESORT COMPANY LIMITED:

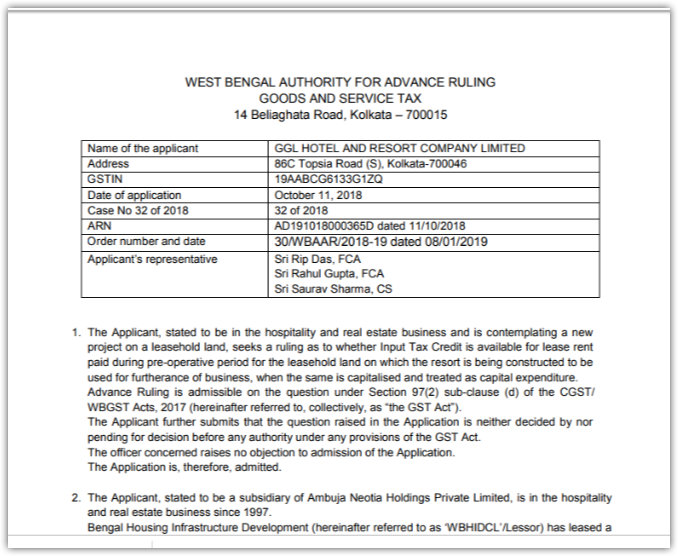

In the GST AAR of GGL Hotel and Resort Company Limited, the applicant has raised the query regarding the whether Input Tax Credit is available for lease rent paid during the pre-operative period for the leasehold land. Following is the GST AAR of GGL Hotel and Resort Company Limited:

Order:

Applicant, stated to be in the hospitality and real estate business and is contemplating a new project on a leasehold land, seeks a ruling as to whether Input Tax Credit is available for lease rent paid during pre-operative period for the leasehold land on which the resort is being constructed to be used for furtherance of business, when the same is capitalized and treated as capital expenditure.

Advance Ruling is admissible on the question under Section 97(2) sub-clause (d) of the CGST/ WBGST Acts, 2017 (hereinafter referred to, collectively, as “the GST Act”).

The Applicant further submits that the question raised in the Application is neither decided by nor pending for decision before any authority under any provisions of the GST Act.officer concerned raises no objection to the admission of the Application.

The Application is, therefore, admitted.

2. The Applicant, stated to be a subsidiary of Ambuja Neotia Holdings Private Limited, is in the hospitality and real estate business since 1997.

Housing Infrastructure Development (hereinafter referred to as ‘WBHIDCL’/Lessor) has leased a piece of land measuring 20,039.75 sq meters in New Town Area for a period of 32 years to the Applicant (also referred to, at times, as the Lessee) for a lease premium of Rupees Seventeen Crores Twenty Lakhs only.

As per the Indenture of Lease dated 21.08.2013, (hereinafter referred to as “the Agreement) the Applicant is liable to pay annual lease rent at the rate of 10% of the aforesaid premium for the first and second year, and the same would be escalated at the rate of 5% per annum, in the subsequent years from the start of the third year over the last annual lease rent per annum.

The project is proposed to be completed within a period of two years from the foundation of the project and the lease rent paid during the pre-operative period shall be capitalized in the books of account by the Applicant.

The concerned officer submits in writing that credit of tax paid on goods and services used for the construction of immovable property is allowed only if such immovable property is in the nature of plant and machinery. The expression plant and machinery has been defined vide Explanation to section 17 in Chapter V of the GST Act to mean apparatus, equipment , and machinery fixed to earth by foundation or structural support that are used for making outward supply of goods or services and includes such foundation and structural supports but excludes inter alia land, building, or any other civil structures. The input tax credit is, therefore, not admissible for the lease rent paid during the pre-operative period for the leasehold land on which a resort is being constructed.

Download the GST AAR of Ggl Hotel and Resort Company Limited, by the clicking the below image:

3. The Applicant states that:

(a) Section 16 of the GST Act deals with eligibility and conditions for taking Input Tax Credit. Sub-section (1) of the said Section states “Every registered person shall, subject to such conditions and restrictions as may be prescribed and in the manner specified in section 49, be entitled to take credit of input tax charged on any supply of goods or services or both to him which are used or intended to be used in the course or furtherance of his business and the said amount shall be credited to the electronic credit ledger of such person.

”(b) Section 17 of the GST Act deals with Apportionment of Credit and Blocked Credit Sub-section 5(d) of the said Section states Notwithstanding anything contained in sub-section (1) of section 16 and subsection (1) of section 18, input tax credit shall not be available in respect of the following, namely: goods or services or both received by a taxable person for construction of an immovable property (other than plant or machinery) on his own account including when such goods or services or both are used in the course or furtherance of business. The expression “construction” is explained to include re-construction, renovation, additions or alterations or repairs, to the extent of capitalization, to the said immovable property.

(c) The GST Act does not define the exact nature of the goods and services received that are deemed to relate to the construction of immovable property. As a result, the meaning of construction cost is to be construed as is taken in the modern parlance. The Applicant is required to pay the lease rent to the Lessor whether or not the construction has been carried out and shall be paying the lease amount even after the completion of the construction of the immovable property for the balance period of the lease period. The lease rent for the pre-operative period is capitalized under the head ‘Leasehold Land’ and not under the head ‘Building Block’. It can, therefore, be inferred that the lease rent is not used for the construction of the resort.

Hence, the renting services cannot be said to be received for the construction of immovable property as there is no nexus, direct or indirect, between the construction of the hotel and banquet and the rental service availed. Further, mere capitalization of the lease rental cannot make such services as received for the construction of immovable property.

4. The moot question, therefore, is whether the lease rental paid during the preoperative period should be treated as part of the cost of goods and services received for the purpose of constructing an immovable property (other than plant and machinery) on the Applicant’s own account. Para 23 of AS10 is relevant. It says that the cost of a self-constructed asset should be determined using the same principles as for an acquired asset, and it is usually the same as the cost of constructing an asset for sale. When an immovable property like a building is sold the profit is computed after deducting from the sale proceeds the cost of the property, including the land. The cost of constructing the immovable asset, therefore, includes the lease rental paid for the right to use the land on which the asset is built. Being an integral part of the cost of the immovable property the lease rental paid for the service of the right to use the land is a supply for construction of the said property.

The Applicant’s argument about the absence of any nexus – direct or indirect – between the lease rental and construction of the buildings for hotel etc. is incorrect. Construction of the hotel etc. is impossible unless the Applicant enjoys uninterrupted right to use the land. It is clear from the Agreement that the Applicant cannot enjoy that right if he fails to pay the lease rental. Construction of the immovable property is, therefore, critically dependent on the supply of the leasing service. The nexus between them is, therefore, direct and the two are inseparable. The leasing service for the right to use the land is, therefore, a supply for construction of the immovable property. The prohibition from availing input tax credit, as provided under section 17(5)(d) of the GST Act, is not limited to the civil structure being constructed. It extends to the immovable property in general (other than plant and machinery), which includes the supplies received for retaining the right to use and develop the land. Such supplies are essential for the construction of the civil structure on the piece of land.

The Applicant will admittedly capitalize the lease premium [refer to the fixed assets schedule: Note 12 to the Balance Sheet as on 31/03/2018, the Application and the Applicant’s written submission on rebuttal to the concerned officer’s views]. The property is, therefore, admittedly being constructed on the Applicant’s own account and treated as a fixed asset, including the lease rental paid. Whether the lease rental paid for the pre-operative period is capitalized under the head ‘Leasehold Land’ or ‘Building Block’ is of little significance in this context.

In the light of the above discussion, it is held that the lease rental paid during the pre-operative period should be treated as part of the cost of goods and services received for the purpose of constructing an immovable property (other than plant and machinery) on the Applicant’s own account. The input tax credit is, therefore, not admissible on such lease rental in terms of section 17(5)(d) of the GST Act.

In view of the foregoing, we rule as under.

RULING:

Input Tax Credit is not available to the Applicant for lease rent paid during the pre-operative period for the leasehold land on which the resort is being constructed on his own account to be used for the furtherance of business when the same is being capitalized and treated as capital expenditure. This ruling is valid subject to the provisions under Section 103 until and unless declared void under Section 104(1) of the GST Act.

Source: http://www.wbcomtax.nic.in/GST/GST_Advance_Ruling/30WBAAR2018-19_20190108.pdf

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.