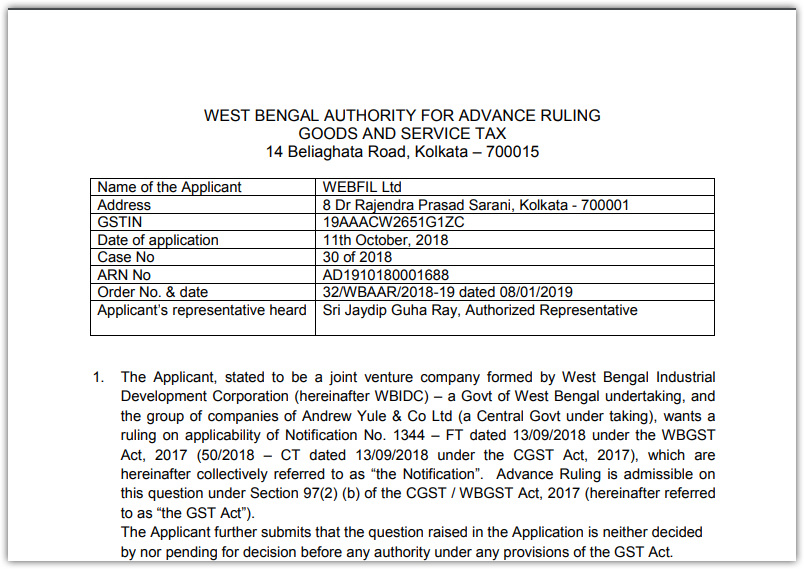

Original Copy GST AAR of WEBFIL Ltd

Original Copy GST AAR of WEBFIL Ltd

In the GST AAR of WEBFiL Ltd, the applicant has raised the ruling on the applicability of Notification No. 1344 – FT dated 13/09/2018 under the WBGST Act, 2017. Following is the order of the GST AAR of WEBFIL Ltd:

Order:

The Applicant, stated to be a joint venture company formed by West Bengal Industrial Development Corporation (hereinafter WBIDC) – a Govt of West Bengal undertaking, and the group of companies of Andrew Yule & Co Ltd (a Central Govt undertaking), wants a ruling on applicability of Notification No. 1344 – FT dated 13/09/2018 under the WBGST Act, 2017 (50/2018 – CT dated 13/09/2018 under the CGST Act, 2017), which are hereinafter collectively referred to as “the Notification”. Advance Ruling is admissible on this question under Section 97(2) (b) of the CGST / WBGST Act, 2017 (hereinafter referred to as “the GST Act”).

The Applicant further submits that the question raised in the Application is neither decided by nor pending for decision before any authority under any provisions of the GST Act. The officer concerned raises no objection. The Application is, therefore admitted.

2. Section 51(1) of the GST Act empowers the Government to mandate (a) a department or establishment of the Central Government or State Government, or

(b) local authority; or

(c) Governmental agencies; or

(d) such persons or category of persons as may be notified by the Government on recommendations of the Council to deduct tax at the rate of 1% from the payment made or credited to the supplier of taxable goods or services, where the total value of such supply under a contract exceeds 2,50,000/-

. The Notification, as amended from time to time, states that the provisions of section 51 of the GST Act shall come into effect from 01/10/2018 with respect to the persons specified under clauses (a), (b) and (c) above, and to the persons specified below under clause (d) of section 51(1): (a) An authority or a board or any other body –

(i) set up by an Act of Parliament or a State Legislature; or

(ii) established by any Government, with 51% or more participation by way of equity or control, to carry out any function

(b) The society established by the Central Govt or the State Govt or a local authority under the Societies Registration Act, 1860;

(c) Public sector undertakings.

However, the Notification shall not apply to the authorities under the Ministry of Defence, other than the authorities specified in the Annexure-A of Notification No. 57/2018 – CT dated 30/10/2018. Furthermore, the Notification shall not apply to supplies from a public sector undertaking to another public sector undertaking.

Download the GST AAR of WEBFiL Ltd, by clicking the below image:

3. According to the Application, WBIDC and Andrew Yule & Co and its associates are “Government Companies” and they together hold 62.29% of the subscribed and paid up share capital of the Applicant. The rest is held by the public. The Applicant is a ‘deemed Government Company’ for the limited purpose of the audit by the C&AG. However, he is not a “Government Company”, as defined under section 2(45) of the Companies Act, 2013, as neither the Central Government nor the State Government subscribes to the paid-up share capital of the Applicant. He is not a subsidiary of any “Government Company” either, as no “Government Company” separately holds more than 51% of the share capital, or exercises control by having the majority in the composition of the Board of Directors. Moreover, the Registrar of Companies, Kolkata, has incorporated the Applicant as a non-Government company.

The Applicant cannot be termed a “Public Sector Undertaking”, where 51% or more of the paid-up share capital is held by the Central or the State Governments.

The Applicant, therefore, argues that the Notification is not applicable to him.

4. The Applicant has nowhere disputed that it has been established by the Government. The Application is silent on this issue. This Authority, therefore, examines the matter based on the arguments put forward and information made available, keeping the above issue open.

5. Section 51(1) of the GST Act, read with the Notification as amended from time to time, mandates that certain categories of recipients shall deduct tax at source at a percentage while making payments to the suppliers above a threshold. Such recipients include inter alia an authority or a board or any other body set up by an Act of Parliament or a State Legislature or established by any Government with 51% or more participation by way of equity or control to carry out any function.

As the GST Act does not define “Control”, it should be construed as defined under the Companies Act, 2013. Section 2(27) of the Companies Act, 2013 defines “Control”. It includes the right to appoint the majority of the directors or to control the management or policy decisions exercisable by a person or persons acting individually or in concert, directly or indirectly, including by virtue of their shareholding or management rights or shareholders agreements or voting agreements or in any other manner.

6. The Applicant was incorporated as a limited company on 25/03/1988 after reconstitution of the erstwhile West Bengal Filaments and Lamp Ltd. From the available materials, it appears that neither the Central Government nor the State Government has any direct equity participation. But the “Government Companies”, as defined under section 2(45) of the Companies Act, 2013, together hold 62.29% of the paid up share capital and the majority of the directors in the Board. WBIDC alone holds 49.46% of the shares and enjoys four votes (including the casting vote of the Chairman) in a nine-member Board. The Central and the State Governments, therefore, acting through the government companies, are in a position to indirectly control the management policy decisions of the Applicant. The Central and the State Governments, therefore, “control” the Applicant within the meaning of Section 2(27) of the Companies Act, 2013.

Clause an (ii) of the Notification is, therefore, applicable for the Applicant if he is established by government notification.

In view of the foregoing, we rule as under.

RULING

The Applicant, if established by government notification, is liable to deduct tax at source under section 51(1) read with Notification No. 1344-FT dated 13/09/2018, is a company controlled by the Central and the State Governments.

This Ruling is valid subject to the provisions under Section 103(2) until and unless declared void under Section 104(1) of the GST Act.

Source: http://www.wbcomtax.nic.in/GST/GST_Advance_Ruling/32WBAAR2018-19_20190108.pdf

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.