Ultra Vires RCM On Sea Freight

Ultra Vires RCM On Sea Freight

- The coverage of Ocean freight under RCM:

There are many dark places in Law. These dark areas scare the taxpayer and the lawmakers too. It becomes a huge responsibility on the shoulders of lawmakers to handle to areas delicately to restore the trust in the heart of business entities. The issue if RCM on sea freight is already in the court to seek the correct position. In this article we will discuss the issue related to this entry of RCM.

| Sl. No. | Category of Supply of Services | Supplier of service | Recipient of Service |

| 10. | Services supplied by a person located in non- taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India. | A person located in non-taxable territory | Importer, as defined in clause (26) of section 2 of the Customs Act, 1962(52 of 1962), located in the taxable territory. |

The term is importer is defined under section 2(26) of Customs Act as:

“Importer”, in relation to any goods at any time between their importation and the time when they are cleared for home consumption, includes any owner or any person holding himself out to be the importer”

Rate to charge RCM on Ocean freight:

Also the entry no. 9. of Notification No. 8/2017 dated 28Th June 2018. Covering the tax rate for heading no. 9965 provide for a tax rate of 5% on Ocean freight.

What should be the value to charge RCM on Ocean freight?

Now the issue which arose, in this case, was what should be the value for the purpose of this RCM. Corrigendum to notification 8/2017 addressed that issues and provided a notional value for payment of RCM. The entry is reproduced here:

“Where the value of taxable service provided by a person located in non-taxable territory to a person located in non-taxable territory by way of transportation of goods by a vessel from a place outside India up to the customs station of clearance in India is not available with the person liable for paying integrated tax, the same shall be deemed to be 10 % of the CIF value (sum of cost, insurance and freight) of imported goods.”

It provided a value of 10% of CIF value to charge RCM.

Another major issue was what should be the document to claim the input tax credit. The supplier to importer does not raise the invoice. Only way-out can be to raise a self-invoice and claim ITC of this tax paid in RCM.

Who is required to pay RCM and on which transaction?

This entry is in dispute since its inception. Let us also have a look on various transactions of import. The most frequent type of consignments imported is CIF and FOB.

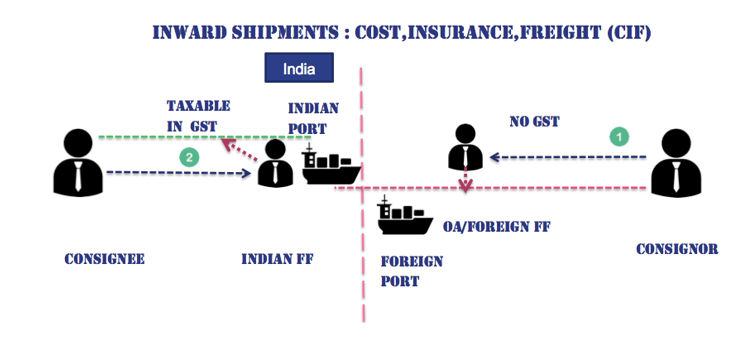

CIF import: In CIF consignment the liability to make the goods available at the Indian port is of the supplier. The supplier himself makes the arrangement of insurance and freight from the port outside India to the port in India. Following is a pictorial presentation of CIF transaction. In this case, the supplier hires the overseas clearing and forwarding agent. Goods are dispatched at Indian port and then Indian recipient collects them and takes the delivery by filing the bill of entry either for warehousing or for home consumption.

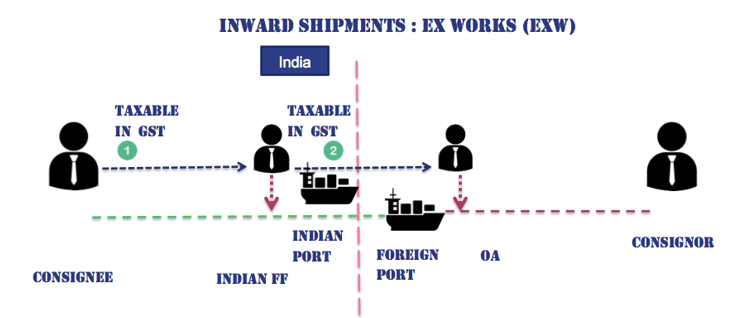

FOB Import: In FOB import the supplier makes an ex-factory sale. The liability for the transportation of goods from foreign port to Indian port is of Importer. Who in turn take the services of a clearing and forwarding agent located outside India? We have inserted this pictorial representation of this transaction to make it more convenient to understand it. As you can see the foreign seller makes an Ex-factory sale. Indian importer hires a C&F agent who also tied up with an overseas agent.

The entry covered in the above notification is of CIF import. It covers the sea freight paid by the foreign supplier to the overseas C&F agent to deliver the goods to the Indian port. The entry covers that supply and makes the importer liable to pay the tax in RCM on the amount f freight paid by the overseas supplier to overseas C&F agent.

Here some important facts against the validity of this entry:

This notification is issued u/s 5(3) of IGST Act, which reads as:

Section 5(3)of IGST Act:

“ The Government may, on the recommendations of the Council, by notification, specify categories of supply of goods or services or both, the tax on which shall be paid on reverse charge basis by the recipient of such goods or services or both and all the provisions of this Act shall apply to such recipient as if he is the person liable for paying the tax in relation to the supply of such goods or services or both.”

(Emphasis supplied)

As you can also notice this part of provision gives a right to government to notify a “Recipient” to pay in RCM. The person covered in this entry and is made liable to pay tax in RCM is not the recipient of the services. In CIF transactions the overseas supplier is the recipient of the services of Freight for movement of goods from his place to the Indian port.

Also, the importer pays the customs duty and IGST on the full value of consignment including these charges.

This is ultra vires the right of Act to levy the tax in RC on the importer for Ocean freight.

Download the PDF: Ultra Vires RCM On Sea Freight

Disclaimer:

The views expressed in this write up are based on personal opinion of the author. It is only for educational purpose and prepared for circulation in clients of ConsultEase.com and Professionals. Neither the author nor the ConsultEase.com will be liable for any action taken based on the opinion expressed

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.