Original order of GST AAR of Skipper Ltd

Original order of GST AAR of Skipper Ltd

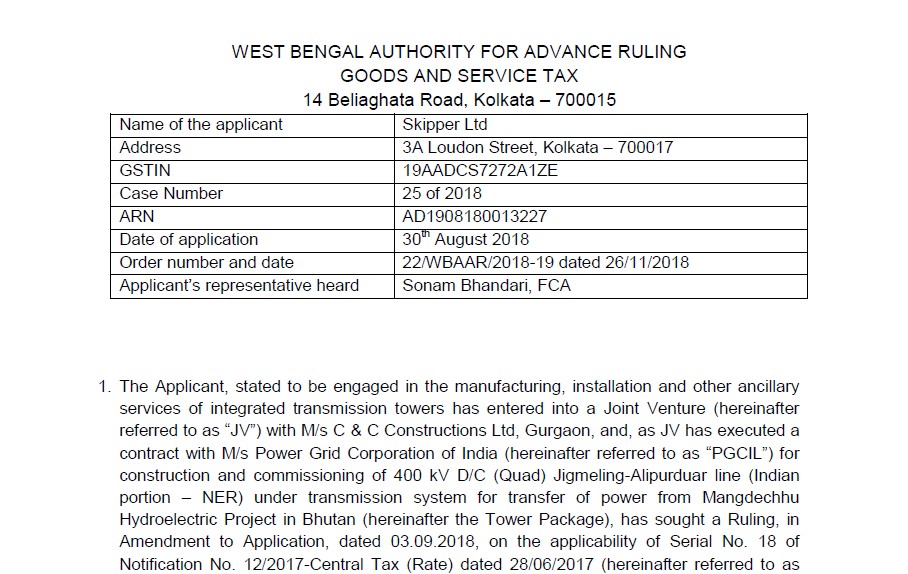

In the GST AAR of Skipper Ltd, the applicant has raised the query regarding the cost of the transportation born by the applicant. The applicant is engaged in Works contract services. Following is the order of GST AAR of Skipper Ltd:

Order:

1. The Applicant, stated to be engaged in the manufacturing, installation and other ancillary services of integrated transmission towers has entered into a Joint Venture (hereinafter referred to as “JV”) with M/s C & C Constructions Ltd, Gurgaon, and, as JV has executed a contract with M/s Power Grid Corporation of India (hereinafter referred to as “PGCIL”) for construction and commissioning of 400 kV D/C (Quad) Jigmeling-Alipurduar line (Indian portion – NER) under transmission system for transfer of power from Mangdechhu Hydroelectric Project in Bhutan (hereinafter the Tower Package), has sought a Ruling, in Amendment to Application, dated 03.09.2018, on the applicability of Serial No. 18 of Notification No. 12/2017-Central Tax (Rate) dated 28/06/2017 (hereinafter referred to as “the Exemption Notification”) to them.

The Applicant’s prayer for Amendment of Application is granted and Advance Ruling is admissible on this question under Section 97(2)(b) of the CGST/WBGST Acts, 2017 (hereinafter referred to, collectively, as “the GST Act”).

The Applicant declares that the issue raised in the application is not pending nor decided in any proceedings under any provisions of the GST Act.

The officer concerned has raised no objection to the admissibility of the Application. The Application is, therefore, admitted.

2. The Applicant refers to the Advance Ruling pronounced by this Authority in the case of EMC Ltd (Case No. 07 of 2018 and Order No. 04/2018-19 dated 11/05/2018) in which this Authority has held that EMC Ltd has not contracted separately for ex-factory supply of materials, but for the composite supply, namely works contract service for construction, erection and commissioning of the Tower Package, of which freight and transportation is merely a component and not a separate and independent identity, and GST is to be paid at 18% on the entire value of the composite supply, including supply of materials, freight and

transportation, erection, commissioning etc.

The Applicant states that while the modus operandi of entering into a contract with PGCIL is similar to that adopted by EMC Ltd, insofar as the contract with PGCIL has been split up into two separate parts – one for ex-factory supply of materials (hereinafter referred to as “the First Contract”), and the other for supply of allied services like erection of towers, testing and commissioning of transmission lines etc. (her inafter referred to as “the Second Contract”), which also includes inland/local transportation, insurance, delivery of materials and storage of them at the contractee PGCIL’s site, the execution of the Towers cannot come under “works contract service”, since it does not involve the supply of any immovable property. Hence, the Advance Ruling for EMC Ltd cannot be relied upon for determining the case of the Applicant.

The Applicant argues that an immovable property, after construction/erection/repair/ commissioning, is attached to the land, structure or building for the permanent beneficial enjoyment of the structure and it cannot be removed without substantial damage to the structure. Transmission towers are attached to the earth to provide structural support to the transmission wires. The purpose of erecting the tower is the beneficial enjoyment of the tower and not of the structure attached to the land (the base on which the tower is erected).

The tower can be dismantled and shifted to another location without major damage, and such shifting of towers is not an uncommon event. Transmission towers are, therefore, not immovable property.

Judgments passed by the High Courts and the Supreme Court in the cases of Essar Telecom Infrastructure Pvt Ltd [(2012) 25 STR 16 (Kar)]; Sri Velayuthaswamy Spinning Mills (P) Ltd (WP Nos. 4434, 4435, 13652, 13653 of 2009); Solid & Correct Engineering Works [(2010) 252 ELT 481 (SC)] are referred to by the Applicant in support of his Argument.

3. On a careful reading of the contracts between the JV and PGCIL it is seen that, in the present context, the contractual obligation between the JV and PGCIL is for construction, erection and commissioning of the Tower Package and not for the erection of a standalone tower. It includes fabrication and supply of all types of transmission line towers and accessories, supply of earth wire, hardware fittings and conductors, earth wire accessories and OPGW and associated fittings and accessories and Tower Earthing required for complete execution of the Package, inland transportation, insurance, delivery, handling of stores, detailed survey of route alignment, profiling, tower spotting, optimization of tower location, soil testing, geotechnical investigations, piling, casting of foundation for tower footings, installation of Tower Earthing, erection of towers, tack welding of bolts and nuts, painting, fixing of insulator strings, stringing of conductors and earth wires/OPGW along with necessary line accessories, stringing of power lines, supply and erection of span markers, obstruction lights for aviation requirement, testing and commissioning of the erected transmission lines and other activities as may be required for completion of the project.

The contractual agreement is found to be in sharp contrast to the narrow focus on the manufacture and installation of standalone towers that the Applicant would like the question to be confined to.

It is clearly a supply of a bundle of goods and services that result in construction, erection and commissioning of the Tower Package.

It, therefore, needs to be ascertained whether the Tower Package, which includes the erection of a series of transmission towers and commissioning of the transmission line, is an immovable property.

4. “Immovable property” is not defined under the GST Act. The term ‘goods’ is defined under Section 2(52) of the GST Act as all kinds of moveable properties other than money and securities but includes actionable claim, growing crops, grass and things attached to or forming part of the land which are agreed to be severed before supply or under a contract of supply.

Property other than goods, money and securities should, therefore, be considered as ‘immovable property’ under the GST Act.

However, in the absence of a definitive explanation under the GST Act, recourse is being taken to other allied Acts dealing with “property” to determine the definition of “Immovable property”. It is seen that Section 3(26) of the General Clauses Act, 1897 defines “Immovable Property” as to include land, benefits to arise out of the land, and things attached to the earth, or permanently fastened to anything attached to the earth;

Section 3 of the Transfer of Property Act, 1882 simply provides that unless there is something repugnant in the subject or context ‘immovable property’ does not include standing timber, growing crops or grass. The Section, however, defines the term “attached to the earth” to mean (a) rooted in the earth, as in the case of trees and shrubs, (b) embedded in the earth, as in the case of walls or buildings, and (c) attached to what is so embedded for permanent beneficial enjoyment of that to which it is attached.

The essential character of ‘immovable property’, as emerges from the above discussion and relevant to the present context is that it is attached to the earth, or permanently fastened to anything attached to the earth, or forming part of the land and not agreed to be severed before supply or under a contract of supply.

5. In Triveni Engineering & Industries Ltd [(2000) 120 ELT 273 (SC)] the Apex Court observes that while determining whether an article is permanently fastened to anything attached to the earth both the intention as well as the factum of fastening has to be ascertained from the facts and circumstances of each case.

In S/S Triveni N L Ltd [RN – 910, 911 & 912 of 2001 (All)] Allahabad High Court observes that ‘permanently fastened to anything attached to the earth’ has to be read in the context for the reason that nothing can be fastened to the earth permanently so that it can never be removed. If the article cannot be used without fastening or attaching it to the earth and is not removed under ordinary circumstances, it may be considered permanently fastened to anything attached to the earth.

Furthermore, in the context of the GST Act, if the article attached to the earth is not agreed to be severed before supply or under a contract for supply, it ceases to be goods and, for that matter, a moveable property.

6. A Tower Package includes the erection of a series of transmission towers linked together by the power line for transmitting electricity. The towers are erected on foundations built on the land, and benefits of the towers cannot be enjoyed unless they are so attached. Once commissioned, the transmission line and the transmission towers are not to be shifted under ordinary circumstances. In fact, the transmission line is being constructed after a detailed survey of route alignment, profiling, tower spotting, optimization of tower location, soil testing, geotechnical investigations etc. and after acquiring the land for the erection of the towers. All these points to the fact that the Tower Package is being constructed for its enjoyment in perpetuity with no plan for removal or shifting in the foreseeable future. The Tower Package being constructed is, therefore, an immovable property.

7. The Applicant has referred to several case laws and judgments in support of the argument that the Towers, so constructed under contract, are not “immovable property”.

a) In Sri Velayuthaswamy Spinning Mills P Ltd (supra) the Madras High Court based its judgment on Section 3 of the Transfer of Property Act, 1882, and held that a windmill is a moveable property, being of the view that if a thing is embedded in the earth or attached to what is so imbedded for the permanent beneficial enjoyment of that to which it is attached, it becomes an immovable property. On the other hand, if the attachment is made for the beneficial enjoyment of the chattel itself, which in this case is the windmill, then it remains a chattel even though fixed for the time being so that it may be enjoyed.

This view of the Madras High Court does not take into consideration the intention of the parties while attaching the chattel to the foundation embedded in the earth and stands in direct opposition to the judgment of the Allahabad High Court in S/S Triveni N L Ltd (supra). In this era of rapid technological advancement, when trees can be relocated, buildings and bridges can be built with pre-fabricated structures, the intention behind attaching a thing to the earth as a factor in determining its mobility cannot be ignored. This factor is taken into consideration while defining goods under the GST Act, where only those things attached to the earth or forming part of the land are included that are agreed to be severed before supply or under a contract of supply. The rest are left out as “immovable property”.

b) In the case of Solid & Correct Engineering Works, (supra), the Apex Court when examining whether a machine, fixed with nuts and bolts to a foundation, with no intent to permanently attach it to the earth, is an immovable property or not, has held that such an attachment without necessary intent to making it permanent cannot be an immovable property. The emphasis is on the intention of the party. The Apex Court observes that the machine in question can be moved and has indeed been moved after the road construction and repair project, for which it was installed, is completed. However, if a machine is intended to be fixed permanently to a structure embedded in the earth, the moveable character of the machine, according to the Supreme Court, becomes extinct.

In the present context, it has already been pointed out that the series of transmission towers are being erected under the Tower Package with no intention of removing or shifting them in foreseeable future.

They are, therefore, clearly intended to be fixed permanently to the foundation embedded in the earth. The moveable character of the towers, therefore, becomes extinct.

c) In the case of Essar Telecom Infrastructure Pvt Ltd (supra), the Karnataka High Court, differing with Bombay High Court’s judgment in Hutchison Max Telecom P Ltd [(2008) 224 ELT 191 (Bom)], observes

that mobile towers do not acquire the character of immovable goods, as they can be dismantled and replanted elsewhere. The Karnataka High Court has not elaborated further on this point.

In view of the differing observations of two High Courts on similar matters, no conclusion needs to be drawn based on them. At this point, it is sufficient to distinguish between the erection of a standalone roof-top mobile tower and that of a series of transmission towers over a stretch of more than hundred kilometres, fastened and linked with power cables. The mobile towers are standalone entities erected usually on roof-tops after an agreement with the owner of the building for using the space for a limited period of time, subject to periodic renewals. On the other hand, the Tower Package involves the erection of a series of towers on acquired land for use in perpetuity. In contrast to the time-bound nature of the agreements for using building spaces for erecting mobile towers, the Tower Package is not being constructed with the contemplation of such relocation. The judgment of Karnataka High Court in the matter of Essar Telecom Infrastructure P Ltd (supra) is, therefore, not applicable in the present context.

8. The Applicant further argues that separate contracts, executed with the explicitly defined separate scope of work and price, should be construed as separate distinct agreements with each of the supplies being separate supplies and refers to several judgments in support of his argument.

The cases referred to are: Hindustan Aeronautics Ltd [(1984) SCR (2) 248]; Gannon Dunkerley & Co [(1959) SCR 379]; Associated Hotels of India [(1972) SCR (2) 937]; Power Grid Corporation of India Ltd [(2007) 112 TTJ Hyd 654].

Reference is also made to Circular No. 47/21/2018-GST dated 08/06/2018 of CBIC to argue that if a supply involves the supply of both goods and services and the value of such goods and services are shown separately, the goods and services are liable to tax at the rates as applicable to them separately. Reference is also made to an e-flyer of CBIC to argue that the trade may well decide whether contractual supplies of goods and services should be treated as a composite supply or various individual supplies. Although integral parts of the contract for the Tower Package, the First Contract and the Second Contract, according to the Applicant, are separate agreements and the two are not naturally bundled. The First Contract stands executed when the goods are delivered to PGCIL at the factory gate. The Second Contract involves all subsequent activities, including transportation etc. and services performed on the goods supplied by the contractee.

In this connection the Applicant refers to a Ruling of Karnataka Authority for Advance Ruling (hereinafter referred to as “KAAR”) in the case of M/s Giriraj Renewables Pvt Ltd. wherein the contract is for setting up a solar power plant, where the contractee imports the solar photovoltaic module (PV Module) and supplies them free of cost to the contractor at the work site. The Ld KAAR observes that the contractor cannot, therefore, claim that he is supplying the PV Module and the other supplies are ancillary to this principal supply. As the goods belong to the contractee at the time of provisioning the services, it cannot be said that the supplies of materials and services are naturally bundled and a composite supply.

Drawing an analogy the Applicant argues that ex-works supply of materials results in the transfer of title of the goods to PGCIL at the factory gate, and all subsequent activities, including transportation etc., are services performed on the goods supplied by the contractee. As the goods belong to the contractee at the time of provisioning the services, it cannot be said that the supplies of materials and services are naturally bundled and are a Composite Supply.

Download the order of GST AAR of Skipper Ltd by clicking the below image:

9. The scope of work for the contract for the Tower Package needs to be examined in some detail. The First Contract includes the ex-works supply of all equipment and materials. The scope of the work includes testing and supply of transmission line towers, spares and accessories thereof, and all other materials required for successful commissioning of the transmission line.

The Applicant argues that the property in the goods passes to PGCIL at the factory gate. Appendix-1 to the First Contract contains Terms and Procedures of Payment. It provides for progressive payment, 10% of which will be made after signing of the Contract Agreement, and 60% will be made upon submission of documents inter alia evidencing dispatch of the goods, insurance, material inspection and clearance etc. 20% of the exworks price component of the fabricated tower parts/tower shall be paid on completion of

their erection. Final payment of the balance 10% shall be made after the erection of all the towers of the transmission line subject to submission of an unconditional and irrevocable bank guarantee covering the above 10% amount, valid till scheduled date for testing and commissioning of the transmission line. If there is an increase in Contract price due to price adjustment, 90% of it shall be paid on receipt of the respective shipment at the site.

Appendix-3 to the First Contract describes the Insurance Requirements. It mandates the JV to provide insurance cover for the transit risk from the manufacturing works of the JV to the project warehouse at final destination and also the risk from the date of receipt at the site and till the date of operational acceptance, indicating that PGCIL does not own up risk in the goods till they are applied to construction, erection and commissioning of the Tower Package.

It is, therefore, abundantly clear that neither the risk in the goods passes to PGCIL at the factory gate nor that the JV will get any payment, other than the advances paid, until and unless the goods are dispatched. Evidently, property in the goods does not pass to PGCIL at the factory gate. The JV needs to move the goods and deliver them at the work site before claiming 60% of the payment for execution of the First Contract. The balance amount is to be paid in phases till completion of erection of all towers of the transmission line.

10. It is immediately apparent from the above discussion that the First Contract cannot be executed independently of the Second Contract. There cannot be any ‘supply of goods’ without a place of supply. As it is evident from the above discussion that title to the goods has not been transferred to PGCIL at the factory gate, supply under the First Contract involves movement and/or installation at the site, and the place of supply shall be the location of the goods at the time when movement of the goods terminates for delivery to PGCIL or moved to the site for assembly or installation [refer to Section 10(1)(a) & (d) of the IGST Act, 2017]. The First Contract, however, does not include the provision and cost of such transportation and delivery. It, therefore, does not amount to a contract for ‘supply of goods’ unless tied up with the Second Contract. In other words, the First Contract has “no leg’ unless supported by the Second Contract. It is no executable contract unless tied up with the Second Contract.

The contractee is aware of such interdependence of the two contracts. Although awarded under two separate agreements, clauses under both of them make it abundantly clear that notwithstanding break-up of the contract price, the contract shall, at all times, be construed as a single source responsibility contract and the Applicant shall remain responsible to ensure execution of both the contracts to achieve successful completion and taking over of the facilities. Any breach in any part of the First Contract shall be treated as a breach of the Second Contract, and vice versa. It is expressly understood that any default or breach under the ‘Second Contract’ shall automatically be deemed as a default or breach of the ‘First Contract’ also and vice-versa, and any such default or breach or occurrence giving the contractee a right to terminate the ‘Second Contract’, either in full or in part, and/or recover damages thereunder.

It is evident that although supplies of goods and services to PGCIL are being made under two separate agreements, they are not executable separately. The First Contract for supply of goods cannot be executed unless tied up with the Second Contract. Unless and until supplies under both the contracts are made and the Tower Package is commissioned, PGCIL is not treating either of the contracts as successfully completed and reserves the right to initiate actions for breach of contract. They are not two neatly separable contracts, where provisioning of services under the Second Contract begins subsequent to transfer of property in the goods to PGCIL under the First Contract, but are indivisible contracts for the bundled supply of goods and services. The ruling of KAAR in the matter of M/s Giriraj Renewables Pvt Ltd is, therefore, not relevant in the present context.

It is thus a single source contract for bundled supplies of goods and services for construction, erection and commissioning of the Tower Package – an immovable property.

11. The Applicant’s reference to several judgments of the apex court is also of little relevance since they are all delivered in the context of situations prior to the 46th Amendment to the Constitution, and are focused on devising the parameters to distinguish between a contract for the sale of goods and works contract. A careful reading of these judgments reveals that the prevailing view of the Apex Court at that time was that no straitjacket formula can be devised that might be applicable under all conditions for distinguishing a contract for the sale of goods from works contract, and it should depend on the facts and circumstances of each case. Dominant intention as reflected in the terms and conditions of the contract and many other aspects are required to be taken into account.

The 46th Amendment to the Constitution has enlarged the scope of tax on the sale of goods by including therein inter alia tax on the transfer of property in goods (whether as goods or in some other form) involved in executing works contract [sub-clause (b) of clause (29A) to Art 366]. A legal fiction is thereby created, which has enabled the State to segregate an indivisible composite works contract into contracts for the sale of goods and for service, and impose a tax on the transfer of property in goods.

The legal history of works contact has since travelled a long way. In Larsen & Toubro Ltd [(2013) 12 SCALE 77] a three-member Constitution Bench of the Apex Court sums it up, describing works contract as a composite contract involving contracts for both service and sale of goods irrespective of dominant intention. Rejecting the traditional view espoused by several earlier judgments of the same court, wherein the focus lied on examining the substance of the contract, Apex Court now holds that the distinction between a contract for the sale of goods and contract for service has almost diminished in the matter of such composite contracts. All that is required is the existence of a contract for construction, erection, commissioning etc. of an immovable property, and execution of the contract must involve the transfer of property in goods (as goods or in some other form), whether or not the goods have been transferred by way of accretion. In its judgment dated 06/05/2014 in Kone Elevator India Pvt Ltd [Writ Petition (Civil) No. 232/2005 and other cases], a fivemember Constitution Bench of the Supreme Court concurs with the above decision.

12. After 101st Amendment of the Constitution, even the legal fiction for segregation of works contract into contracts for the sale of goods and for service is no longer necessary for the purpose of taxation. Clause 12A to Art 366 defines tax on supply of goods and services. Tax on the supply of goods includes a tax on the sale of goods as defined in Clause (29A) of Art 366. However, GST being a tax on the supply of both goods and services, it is no longer necessary to segregate the supply of goods in an indivisible composite contract for the purpose of taxation. GST can be levied on the entire value chain, which is the bundled supply of goods and services for execution of an indivisible composite contract for construction, erection, commissioning etc. of an immovable property.

Works contract is, therefore, defined under section 2(119) of the GST Act as a contract for construction, fabrication, completion, erection, installation, fitting out, improvement, modification, repair, maintenance, renovation, alteration or commissioning of any immovable property wherein transfer of property in goods (whether as goods or in some other form) is involved in the execution of such contract.

Discussion in the preceding paragraphs establishes that the Applicant is executing an indivisible composite contract for construction, erection and commissioning of an immovable property, namely the Tower Package, execution of which involves bundled supply of both goods and services.

It is, therefore, works contract, as defined under Section 2(119) of the GST Act.

13. The contract for the Tower Package as above, being works contract is service in terms of paragraph 6(a) to Schedule II to the GST Act. Activities covered under Schedule II are to be treated as a supply of the nature described under section 7(1)(d) of the GST Act.

Reference to Circular No. 47/21/2018-GST dated 08/06/2018 of CBIC or the e-flyer is, therefore, not relevant in the present context.

The price components of both the First and the Second Contracts, including that for transportation, in-transit insurance etc. are, therefore, to be clubbed together to arrive at the value of the supply of works contract service as discussed above. Transportation of goods and in-transit insurance, being merely parts of the bundled services, should to be treated as components of the value of the works contract and not as

separate and independent supplies.

The exemption under serial no. 18 of the Exemption Notification is, therefore, not applicable in the present context.

Ruling:

In view of the foregoing, we rule as under

The Applicant supplies works contract service, the value of which includes inter alia consideration paid for transportation and in-transit insurance. GST is to be paid on the entire value of the works contract, including the supply of materials, transportation, intransit insurance, erection, commissioning etc.

The exemption under serial no. 18 of Notification No. 12/2017-Central Tax (Rate) dated 28/06/2017 is, therefore, not applicable in the present context.

This Ruling is valid subject to the provisions under Section 103 until and unless declared

void under Section 104(1) of the GST Act.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.