Original copy of GST AAR of KPH Dream Cricket Pvt. Ltd.

Original copy of GST AAR of KPH Dream Cricket Pvt. Ltd.

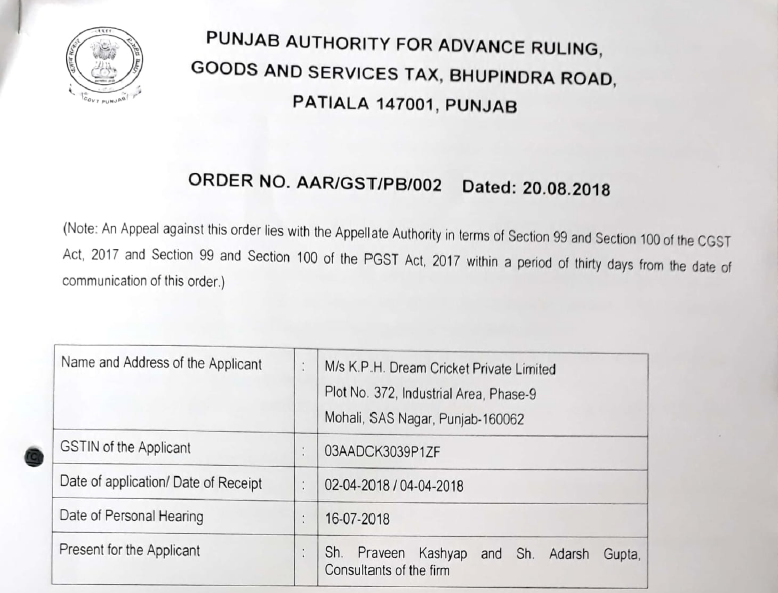

In the GST AAR of KPH Dream Cricket Private Limited. Applicant has raised the query regarding the nature of the “Complimentary Tickets”. Whether they are considered as supply or not. The GST AAR of KPH Dream Cricket Private Limited is as follows:

Order:

M/s K.P.H Dream Cricket Private Limited, Plot No. 372, Industrial Area, Phase-9, Mohali, SAS Nagar, Punjab-160062 hereinafter referred to as ‘applicant’ had submitted an application for advance ruling in form GST ARA-01 vide his letter dated 02.04.2018 received on 04.04.2018 seeking to know

1. Whether free tickets given as “Complimentary Tickets” falls within the definition of supply under CGST Act, 2017 and thus, whether the applicant is required to pay GST on such free tickets?

2. Whether the applicant is eligible to claim Input Tax Credit (for short “ITC”) in respect of complimentary tickets?

In this regard, comments from the concerned officer i.e. Assistant Commissioner of State Taxes, S A S Nagar, Mohali were sought. The concerned officer vide his letter dated 24-05-2018 stated that free tickets given as ‘Complimentary Tickets” fall within the definition of supply under CGST Act, 2017 and thus, the applicant is required to pay GST on such free tickets and applicant is also eligible to claim Input Tax Credit in respect of complimentary tickets. A personal hearing of the applicant in this regard was held on 16.07.2018 before the Advance Ruling Authority, Punjab on which date Sh, Praveen Kashyap and Sh, Adarsh Gupta, Consultants of the firm appeared on behalf of the applicant. The questions raised by the applicant were discussed at length. The consultants requested for adjournment for submission of documents. On their request, the case was adjourned with the directions to submit written submission by 30-07-2018 The applicant has sent written submission through e-mail received on 30-07-2018, which is reproduced as under:

Written submissions & synopsis by the Applicant in respect of the application for Advance Ruling:

1. That, M/s KPH Dream Cricket Private Limited (for shod “applicant” or “KPH”). having its registered office at Plot No 372 Industrial Area Phase-9, Mohali, SAS Nagar, Punjab-160062 is a franchisee of Board of Control for Cricket in India (for short “BCCl”) for the purpose of establishing and operating a cricket team to participate in Indian Premier League T20 cricket tournament (for short IPL”), under the title of “Kings XI Punjab”.

2. That IPL is a domestic professional Twenty-20 cricket tournament in India, organized by BCCI-IPL every year under the gaming rules as prescribed by the BCCI-IPL and International Cricket Council (ICC).

3. The Applicant has participated in a bid invited by the BCCI and after being successful in the said bid, entered into a Franchise Agreement, the Appellant has been permitted to establish and operate the team ‘Kings XI Punjab’.

4. Furthermore, the Applicant to participate in IPL with other franchisees wherein few matches are held at each franchisee’s home ground During the financial year 2018-19, the Appellant will participate in IPL Including the matches held at their home grounds in Mohali (Punjab) and Indore (Madhya Pradesh).

5. The applicant proposes to provide “Complimentary tickets” on account of courtesy/public relationship/promotion of business where no flow of consideration from the recipient/holder.

6. The applicant has filed an application under section 97 of Central Goods & Services Tax Act 2017 (for short “CGST Act”) seeking an advance ruling.

The questions for which advance ruling is sought are –

a. Whether free tickets given as “Complimentary Tickets” falls within the definition of supply under CGST Act, 2017 and thus, whether the applicant is required to pay GST on such free tickets?

b. Whether the applicant is eligible to claim Input Tax credit (for short “ITC”) in respect of complimentary tickets?

In furtherance to our justification stated in our above stated application for Advance ruling, the Applicant wishes to submit following additional submissions with a request to be taken into consideration to decide the matter.

ADDITIONAL SUBMISSIONS

7. The Goods and Services Tax (GST) regime has introduced a concept of ‘supply’ as a taxable event and done away with the erstwhile taxable events of sale, service, manufacture etc. This inter-alia require fresh thoughts for treatment of various transactions and events.

8. While the term ‘free supply’ is not defined under GST law or the erstwhile indirect tax laws, a ‘free supply’ as the name suggests is a supply of goods or services without any consideration (Monetary or Kind) We find it pertinent here to understand the treatment of free supply under pre-GST regime:-

a. Free supply of goods was not taxable as Value Added Tax (VAT)/ Central Sales Tax (CST) was chargeable only on ‘sales’ The term ‘Sales’ was defined under the Sale of Goods Act, 1930 which was followed to State VAT laws to mean a transfer of goods for a consideration.

b. Free supply of services was not chargeable to Service Tax as Service Tax was liable to be paid on the gross amount charged for services, and the term ‘service’ was defined to mean an activity provided by one person to another for consideration.

Under the GST regime, treatment of free supply has undergone a change on following grounds –

• Firstly, the treatment of free supplies made to related and unrelated parties differ.

• Secondly, even though GST was contemplated to treat goods and services a like, provisions relating to credit of free supplies of goods differ from those relating to credit of free supply of services.

Free supply and its taxability under GST

9. Under GST, the incidence of tax is ‘.supply’ The term ‘supply’ has been defined in an inclusive manner under Section 7 of the CGST Act. What this effectively means is that the definition is not exhaustive, and there may be some supplies which are not specified within the definition of the term.

10. The term ‘supply’ is defined to include all forms of sale, transfers, exchanges, barters etc. made or agreed to be made for a consideration in the course or furtherance of business. However, supplies between related persons or distinct persons (different offices of the same entity) in the course or furtherance of business even if not for a consideration are supplies (in terms of Schedule I to the CGST Act). As a result, free supplies between unrelated persons, cannot be said to ‘supplies’, therefore, not taxable. Whereas free supplies between related persons are ‘supplies’ and therefore, taxable.

11. The term ‘related persons’ has been defined in the explanation to Section 15 of the CGST Act. The said definition of term ‘related persons’ reads as under:-

” (a) persons shall be deemed to be “related persons” if-

(i) such persons are officers or directors of one another’s businesses;

(ii) such persons are legally recognized partners in business;

(iii) such persons are employer and employee;

(iv) any person directly or indirectly owns, controls or holds twenty-five per cent or more of the outstanding voting stock or shares of both of them;

(v) one of them directly or indirectly controls the other;

(vi) both of them are directly or indirectly controlled by a third person;

(vii) together they directly or indirectly control a third person; or

(viii) they are members of the same family;

(b) the term “person” also includes legal persons;

(c) persons who are associated in the business of one another in that one is the sole agent or sole distributor or sole concessionaire howsoever described, of the other, shall be deemed to be related.”

On perusal of above cited definition of the term ‘related person’, one may safely conclude that the applicant and the ticket holder (recipient) cannot be covered under any entry and thus cannot be said to a related person.

12. In light of the above stated legal provisions and discussion, it is view of the applicant that the activity of providing complimentary tickets without any consideration on account of courtesy/public relationship/business promotion would not fall under the definition of supply as given under Section 7 of the CGST Act, 2017 and Schedule I of CGST Act, 2017 and thus not exigible to GST.

Input tax credit

13. One of the major advantages sought to be achieved from implementation of GST is the removal of cascading effect by facilitating seamless flow of credit. The “statement of Objects and Reasons” to the Constitution (122nd Amendment) Bill, 2014, enacted as the Constitution (101st Amendment) Act, 2016 categorically includes elimination of cascading effect This would be achieved by providing for the availment of Input tax credit to the purchasing dealer in respect of the tax charged by the supplying dealer.

14. With a view to avoiding the cascading effect of taxes and build-up of tax costs, the government has consciously streamlined the credit restrictions applicable under the GST regime Section 17(5) specifically restricts credit of input tax on goods disposed of by way of free samples. It is relevant to note that the manner in which this provision has been drafted. when read along with credit reversal formula. suggests that credit is restricted only where such goods are disposed as is, and not necessarily in cases where such goods are incorporated into a final product which is disposed free of cost. Therefore, it appears that credit relating to traded goods supplied free of cost is restricted. whereas credit relating to manufactured goods supplied free of cost may not restricted.

15. As regards free supply of services, the CGST Act does not prescribe any credit restriction Therefore, in view of the applicant even though the output (free supplies of) services are not taxed, there is no need for reversal of input tax credit.

Download the GST AAR of KPH Dream Cricket Pvt. Ltd. By clicking the below image:

17. The meaning of supply made in the course or furtherance of business given in the FAQ on GST released by CBEC says – No definition or test as to whether the activity is in the course of furtherance of business has been specified under the CGST Act. However, the following business test is normally applied to arrive at a conclusion whether a supply has been made in the course or furtherance of business.

a. Is the activity, a serious undertaking earnestly pursued?

b. Is the activity, pursued with reasonable or recognizable continuity?

c. Is the activity, conducted in a regular manner based on sound and recognized business principles?

d. Is the activity, predominantly concerned with the making of taxable supply for consideration/ profit motive?

Accordingly, when the inputs and/ or input services are said to be used in furtherance of business, the use of such supplies should help in achieving the objectives of the business in a better and effective way. thus corresponding credit is allowed

18. Section 17(2) provides that where the goods and/or services are used partly for effecting taxable supplies including zero-rated under this act or under the IGST Act, 2016 and partly for effecting exempt supplies under the said acts, the amount of credit shall be restricted to so much of the input tax as is attributable to the said taxable supplies including zero-rated supplies Supply of complimentary tickets is not a supply in itself and thus cannot be said to be an exempt supply.

19. Further Section 17(3) provides that the value of exemption supply under sub section (2) shall be such as may be prescribed Reference to chapter V (Input Tax credit) of CGST Rules 2017, there Is no valuation mechanism prescribed for free supplies Explanation to Rule 42, of CGST Rules 2017 clarifies ‘ For the purpose of this clause, it is hereby clarifies that the aggregate values of exempt supplies and the total turnover shall exclude the amount of any duty or tax levied under entry 84 of List I of the seventh schedule to the constitution and entry 51 and 54 of list II of the said schedule’. Thus assuming but not agreeing if supply of free tickets is said to be exempt supply. there are no machinery provisions for valuation of free supplies and calculation of ITC reversal thereof under CGST Act 2017 read with CGST Rules 2017 ibid.

20. It is a settled position that Input Tax Credit is an indefeasible right of the assesses which cannot be forfeited in absence of any ambiguity or clarity.

Free supplies

21. The act of giving free supplies is similar to the promotional and advertising activities undertaken by every business which are the basic ingredients and inevitable. Moreover, when a business makes a free supply, the cost which the business has incurred is always taken into account by him in fixing the price of the rest of supplies. Thus, albeit-indirectly, the exchequer will get GST even on the value of the free supplies and there is no revenue loss as such to the government. Similar observation has been made by Hon’ble Gujarat High Court in Para 17, in the case of Ruby Laboratories [ Ruby Laboratories vs. Commissioner of Sales Tax on 26 November, 1970 (1971 27 STC 326 Guj)]

22. If business promotion and advertisement expenses are not specifically excluded and are considered as ‘in the course or furtherance of business’ then in view of the applicant same treatment is available for free supplies.

23. Following are some of the similar transactions wherein the question of claiming ITC for free supply of services could arise and have possible implications:-

a. Free consultancy services by a lawyer/ chartered accountant

b. Complimentary movie tickets in a FM Radio show.

c. First night free on Hotel booking on various online portals.

Thus if ITC is eligible for the above listed events, similar treatment should be available for free supplies of complimentary tickets and in view of the applicant ITC should be freely available.

24. The eligibility of credit on free supply also has undergone the test of judicial interpretation by House of Lords. In the case of (Customs and Excise Commissioners vs. Professional Footballers’ Association (Enterprises) Ltd [1993] 1 WLR 153, 157; [1993] STC 86, 90), the taxpayer company was responsible for the organization of an annual awards dinner for a footballers’ association, for which it purchased trophies for presentation to the player of the year and other award winners. The association’s members purchased tickets for the dinner at a price fixed by the company with the aim of covering the expenses incurred. The company collected VAT on the sale of such tickets sold and also claimed a VAT credit in respect of the input tax paid on the purchase of trophies. The credit was disputed on the grounds that the trophies were distributed free of cost and therefore, no credit could be claimed. The House of Lords held that where a direct link could be shown between the giving of those assets and consideration received by the taxpayer from persons other than the recipients, that the awards dinner had been organized as a self-supporting event, for which the ticket receipts were intended to cover the total cost including the provision of trophies; and that accordingly, the purchase of the tickets provided the consideration for the supply of trophies to the award winners and output tax was not payable separately by the company on that value.

Circular No. 47/21/2018-GST dated 8th June 2018

25. We, respectfully wish to bring to your notice that CBIC has issued a clarification vide Circular No. 47/21/2018-GST dated 8th June 2018 vide which it has been clarified that supply of FOC basis does not constitute a supply as there is no consideration involved. It also clarifies that where FOC supply is made in the course of furtherance of business, there is no requirement of reversal of credit Relevant abstract of the circular is re-produced hereunder-

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.