Introduction of VAT in UAE

Introduction of VAT in UAE

GCC i.e. Gulf Cooperation Council is a political and economic alliance of six middle eastern countries- Saudi Arabia, Kuwait, UAE, Qatar, Bahrain and Oman. The GCC was established in Saudi Arabia in May 1981. The objective of the GCC is to achieve unity among members based on their common objectives and their similar political and cultural identities. In line with their objective the GCC has come up with a unified agreement for VAT which sets out the framework under which VAT can be implemented in each of the GCC member states. Each member state can draft its own local law and implement VAT. The framework paves the way for implementation, allowing standard rate of VAT to be charged on most of the Supplies made within the GCC member states implementing VAT, with certain supplies of goods and services zero rated or VAT exempt to member states.

Factors leading to introduction of VAT in GCC

GCC countries have always been highly dependent on oil, the largest revenue contributor to most of these countries’ economic growth. The region has witnessed an acute deterioration in its external and fiscal balances over the past three years primarily due to weak oil prices. Although large fiscal buffers provided some cushion to GCC countries, sustained weakness in oil prices has forced the Gulf nations to adopt a series of reforms. Considering all the above issues, GCC countries plan to introduce a Value Added Tax (VAT) of 5% in January 2018 in a bid to increase government revenue which will be a steady revenue rather than volatile. According to IMF, revenue from VAT would contribute 2.1% to the UAE’s GDP. Qatar and Kuwait are expected to generate around 1.1% and 2% of the GDP, respectively, through the implementation of VAT.

Types of Supply under UAE VAT law

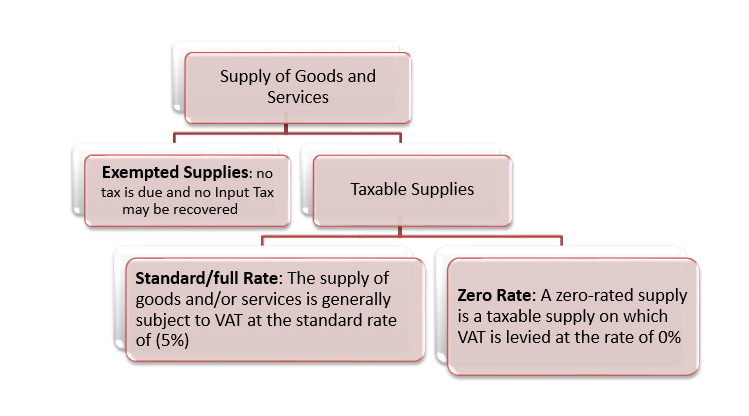

Under VAT law types of supply can be mainly categorized into exempt and taxable supplies. Taxable Supplies are under 2 categories i.e. Standard Rated i.e. @ 5% and Zero rated supplies.

A person making only exempt supplies cannot register for VAT as the person is not providing taxable supplies as per the VAT Act.

Article 46 of Decree-Law: Supply Exempt from Tax

The Following Supplies shall be exempt from Tax:

- Financial Services that are specified in the Executive Regulation of this Decree-Law. Financial services that are specified in the Article (42) of Executive Regulations of this VAT Decree Law, which is defined as services connected to dealings in money (or its equivalent) and the provision of credit, where they are not conducted in return for an explicit fee, discount, commission, rebate or similar charge.

- Supply of residential buildings through sale or lease, other than that which is zero rated according to clauses (9) and (11) of Article (45) of this Decree-Law. As per Article (43) of the Executive Regulations, the supply of residential buildings through sale or lease is exempt, unless it is zero-rated, where in case of lease, the lease period is more than 6 months or the tenant of the property is a holder of an ID card issued by the Federal Authority and Citizenship.

- Supply of bare Land.

- Supply of Local Passenger Transport in a qualifying means of transport by land, water or air from a place in the State to another place in the State.

Registration in VAT: No registration is required under this Decree-Law for a business engaged in providing fully VAT exempt supplies. However, in case of business which makes partly exempt supplies and partly taxable supplies, the business registration provisions will apply accordingly for taxable supplies and threshold will be computed accordingly. Any person registered or obliged to register for Tax purposes is termed as taxable person.

Returns in VAT: No returns are required to be filed under this Decree Law by fully exempt business. However, in case the person is carrying on partly exempt and partly taxable supplies, the Taxable Person is required to submit tax returns for each specified period containing all information and data as specified about supplies of all kinds (Including exempt supplies) provided during the relevant period and details of Input VAT reclaimed

Zero Rates Supplies:

The following items are subject to zero rates:

- Export [direct or indirect] of goods and services outside the implementing states.

- International transport of passenger or goods.

- Air passenger transport in the UAE.

- Supply of an aircraft that is designed or adapted to be used for commercial transportation of passengers or Goods and which is not designed or adapted for recreation, pleasure or sports.

- Supply of a ship, boat or floating structure that is designed or adapted for use for commercial purposes and which is not designed or adapted for recreation, pleasure or sports.

- Supply of a bus or train that is designed or adapted to be used for public transportation of (10) or more passengers.

- Supply of Aircrafts and vessels designated for rescue and assistance by air or sea.

- The supply or import of precious metal for investment purposes.

- First supply of residential buildings as defined in Article (37) of the Executive Regulations within three years of their completion, either through sale or lease in whole or in part.

- First supply of buildings specifically designed to be used by charities.

- First supply of buildings converted from non-residential to residential either through sale or lease, provided that the supply takes place within 3 years of the completion of the conversion and the original building, or any part of it.

- Supply of crude oil and natural gas.

- Supply of educational services by nurseries, preschool, school and higher educational institutions.

The supply of specified preventive and basic healthcare services(Article (41) of Executive Regulations) that is generally accepted in the medical profession as being necessary for the treatment of the Recipient of the supply including preventive treatment; and related goods and services, which includes any pharmaceutical products or any medical equipment identified in a decision issued by the Cabinet.

Non Supply Items

These are items which fall beyond the ambit of ‘Supply’ boundary and hence, are outside the scope of UAE VAT Decree-Law:

- Supply of goods or services, other than those specified in the VAT Executive Regulation.

- Supply of goods made outside the UAE.

- Supplies made by unregistered business, whose turnover is below the mandatory threshold limit specified in the Article (7) of Executive Regulations.

- The supply by Government entities, if supply is made in the sovereign capacity and activity undertaken is monopolistic in nature.

- Purchases made from an unregistered person.

- If the value of the supply of the Goods, for each Recipient of Goods within a 12- month period, does not exceed the amount of AED 500, and the Goods were supplied as samples or commercial gifts.

- If the total Output Tax due for all the Deemed Supplies per Person for a 12-month period is less than AED 2000.

- The sale or issuance of any Voucher unless the received consideration exceeds its advertised monetary value.

- The transfer of whole or an independent part of a Business from a Person to a Taxable Person for the purposes of continuing the Business that was transferred.

- Wages and salaries paid to employees under contractual obligation.

- Capital induction or withdrawal from the business by owners/ shareholders.

- Any supply made by a member of the Tax Group to another member of the same Tax Group.

Disclaimer

All rights reserved. No part of this Article may be reproduced, stored in a retrieval system, or transmitted, in any form, or by any means, electronic, mechanical, photocopying, recording, or otherwise without prior permission, in writing, from the author.

About Author

Author of this article is CA Deepak Bharti who is member of ICAI. Currently he is working as partner in M/s N A V & Co. Chartered Accountants, handling the Corporate Compliance and Legal Department. He can be reached at cadeepakbharti@yahoo.com. Suggestions/comments are most welcome.

If you already have a premium membership, Sign In.

CA Deepak Bharti

CA Deepak Bharti

Delhi, India