Original GST AAR of M/s. Rajagiri Health Care & Education Trust

Original GST AAR of M/s. Rajagiri Health Care & Education Trust

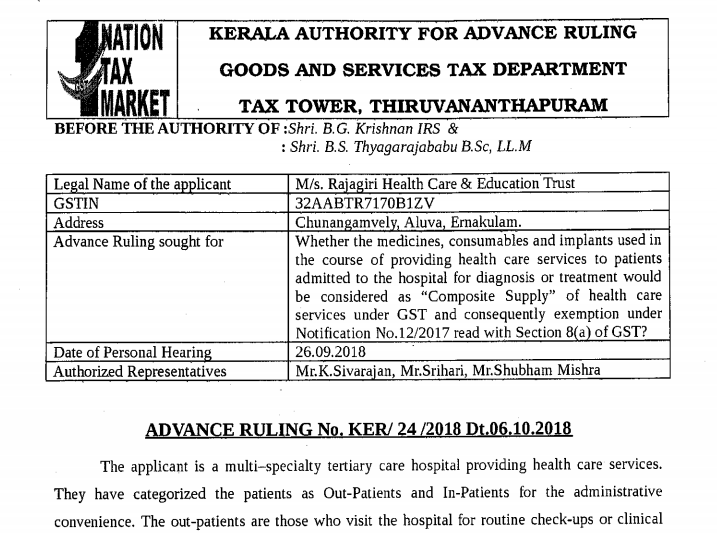

In the GST AAR of M/s. Rajagiri Health Care & Education Trust. The applicant has raised the query regarding the nature of additional services provided by him to in-patients. Following is the GST AAR of M/s. Rajagiri Health Care & Education Trust:

Order:

The applicant is a multi-specialty tertiary care hospital providing health care services. They have categorized the patients as Out-Patients and In-Patients for the administrative convenience. The out-patients are those who visit the hospital for routine check-ups or clinical visits. The in-patients are those who are admitted in to the hospital for the required treatment. The in- patients are provided with stay facilities, medicines, consumables, implants, dietary food and other surgeries/ procedures required for the treatment.

The Central store of the hospital procures stocks of medicines, implants, consumables etc from various suppliers and distribute to its outlets such as in-patient pharmacy, operation theater pharmacy and out-patient pharmacy based on the indent issued. The in-patient pharmacy and operation theater pharmacy supplied medicines, implants and consumables only to in-patients. Whereas the ‘out-patient pharmacy attached to the hospital entertain the medical prescription of out-patients and outside customers with valid prescription.

The medicines, consumables and implants used in the course of providing health care services to the patients admitted for diagnosis or treatment in the hospital or clinical establishment is naturally bundled in ordinary course of business. The patients expected to receive health care services includes receiving the appropriate medicine, relevant consumables, or implants required to make sure that appropriate diagnosis or the best possible treatment of the health issues are conducted. If there is no supply of medicines, consumables or implants, not only the health care service but also the life will also be at stake. Being a composite supply the principal supply is predominant and the room rent and dietary food provided to in-patients are ancillary supply. The applicant sought for an advance ruling on the following:

Whether the medicines, consumables and implants used in the course of providing health care services to patients admitted to the hospital for diagnosis , or treatment would be considered as “Composite Supply” of health care services under GST and consequently exemption under Notification No.12/2017 read with Section 8(a) of GST?

The authorized representative of the applicant was heard. It is stated that, the medicines, consumables and implants used in the course of providing diagnosis or treatment to the inpatients would be part of ‘composite supply’ of health care services vide classification 9993. Composite supply would mean a supply made by a taxable person to a recipient consisting of two or more taxable supplies of goods or services or both or any combination thereof, which are naturally bundled and supplied in conjunction with each other in the ordinary course of business, one of which is a principal supply. The applicant provides more than two taxable supplies such as room rent, medicines, dietary food, consumables etc along with health care treatment to inpatients. Supplies of these services are part and parcel of the treatment and they are essentially required to provide health care services. These are naturally bundled in the ordinary course of business. ‘Bundled service’ means a bundle of provision of various services wherein an element of provision of one service is combined with an element or elements of provision of any other service or services.

The medicines, consumables, implants etc are supplied during the diagnosis or treatment are in conjunction with each other used in the ordinary course of providing the health care services to the in-patients. Medical consultation service, nursing services, supply of medicines, consumables and implants are integral services of health care.

Notification No.12/2017 Central Tax exempt health care services provided by an authorized clinical establishment. The applicant is providing health care services to its patients. The medicines and surgical items supplied to the patients under medical prescription of doctors is incidental to the health services rendered in the hospital entitled to exemption being health care services. There are several decisions pertaining to the point that the supply of medicines, surgical items, etc to the patients in the course of treatment by hospital cannot be said to be sale.

The issue is examined in detail. Health care services provided by a clinical establishment an authorized medical practitioner or para medics are exempted vide Sl.No.74 of Notification No.12/2017-CT (Rate) Dt.28.06.2017. The word ‘clinical establishment’ means a hospital, nursing home, clinic, sanatorium or any other institution by, whatever name called, that offers services or facilities requiring diagnostics or treatment or care for illness, injury, deformity, abnormality or pregnancy in any recognized system of medicines in India or a place established as an independent entity or a part of an establishment to carry out diagnostic or investigative services of diseases.

The in-patient services are classified as exempted service under the sub-group 9993 11. Patients are only admitted to a hospital when they are extremely ill or have severe physical trauma. As far as an inpatient is concerned, hospital is expected to provide lodging, care, medicine and food as part of treatment under supervision till discharge from the hospital. The nature of the various services in a bundle of services will help in determining whether the services are bundled in the ordinary course of business. If the nature of services is such that one of the services is the main service and other services combined with such service are in the nature of incidental or ancillary services which help in better utility of main service.

Download the original GST AAR of M/s. Rajagiri Health Care & Education Trust. By clicking the below image:

Hence the medicines, implants, room provided on rent, dietary food advised by nutritionists etc used in the course of providing health care services to the patients admitted for diagnosis or treatment in the hospital or clinical establishment is undoubtedly naturally bundled in the ordinary course of business. The patients expect to receive health care services by way of an appropriate diagnosis, appropriate medicines as well as relevant consumables or implants required to make sure that they get the best possible treatment. Hence the medicine and allied goods supplied to inpatient are indispensable items and it is a composite supply to facilitate health care services. This authority has already given a Ruling in this regard vide order No. KER/16/2018 Dt.26.09.2018 to the effect that the supply of medicines and allied items provided by the hospital through the pharmacy to the in-patients is part of composite supply of health care treatment and not separately taxable.

Pharmacy is an outlet to dispense medicines or allied items based on prescription. The inpatient pharmacy and operation theater pharmacy supplied medicines and consumables only to in-patients. Whereas an outpatient is concerned, hospital gives only prescription, which is an advisory in nature. The patient has absolute freedom to follow the prescription or not. Similarly there is freedom to procure the medicines or allied items prescribed, either from the pharmacy run by the hospital or from any other medicine dispensing outlets. Hospital reserves no control over his continuous treatment. As far as an outpatient is concerned there is no difference for procuring medicine either from the dispensing outlet within the hospital or from outside the hospital. In both places medicines dispensed based on prescription. Hence there is no privilege for the hospitals that are dispensing medicine to outpatients. Therefore pharmacy run by hospital dispensing medicine to outpatient or bye standers or others can be treated as individual supply of medicine and not covered under the ambit of health care services. Hence such supply of medicine and allied goods are taxable.

The government of India vice Circular No.27/01/2018-GST Dt.04-01-2018 has clarified that room rent in the hospital is exempted. As for as inpatients are concerned, room facility in a hospital is one limb of bundled service of health care. The clarifications issued based on the approval of 25th GST Council Meeting held on 18-01-2018 [F.No.354/17/2018-TRU Dt. 12-02-2018, it was clarified that food supplied to the inpatients as advised by the doctor/nutritionist is a part of the composite supply of health care and not separately taxable. Other supplies of food by the hospital to patients not admitted are taxable. The same principle is applicable in the case of dispensing of medicine also.

Ruling:

In view of the observations stated above, the following rulings are issued:

The supply of medicines, consumables and implants used in the course of providing health care services to in-patients for diagnosis or treatment are naturally bundled and are provided in conjunction with each other, would be considered as “Composite Supply” and eligible for exemption under the category ‘health care services’.

Source: http://keralataxes.gov.in/wp-content/uploads/2018/04/Rajagiri.pdf

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.