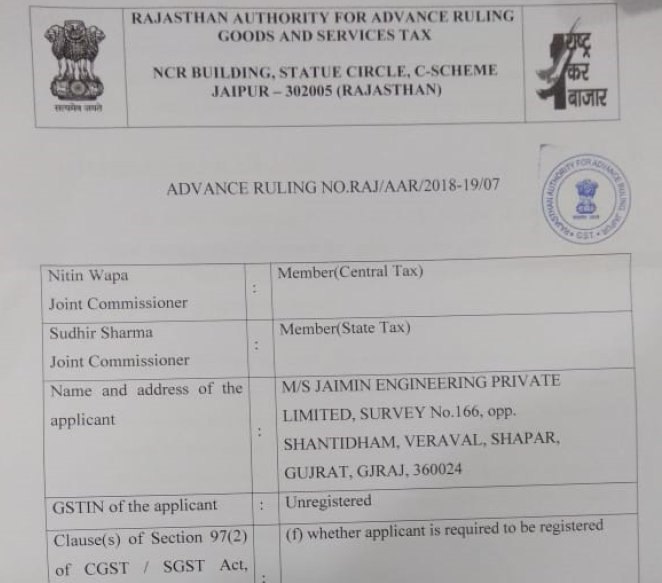

Original order of GST AAR of Jaimin Engineering Pvt Ltd

Original order of GST AAR of Jaimin Engineering Pvt Ltd

In the GST AAR of Jaimin Engineering Pvt Ltd. The applicant has raised the query regarding the liability to take the registration in the different state. Following is the GST AAR of Jaimin Engineering Pvt Ltd:

Order:

1. SUBMISSION OF THE APPLICANT:

M/s Jaimin Engineering Private Limited is engaged in the construction of Cold storage. GST provisions for registration are covered in Chapter 6 of CGST Act. Section 22 of CGST Act provide for the basic requirement for registration as reproduced below:

Every supplier shall be liable to be registered under this Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds twenty lakh rupees:

Provided that where such person makes taxable supplies of goods or services or both from any of the special category States, he shall be liable to be registered if his aggregate turnover in a financial year exceeds ten lakh rupees.

Also section 2(71) provide the location of supplier. We can say that the place from where the supply is made will be taken as a location of supplier. In our case the supply will be made from Gujarat.

Section 2(71) “location of the supplier of services” means,-

(a) where a supply is made from a place of business for which the registration has been obtained, the location of such place of business;

(b) where a supply is made from a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment;

(c) where a supply is made from more than one establishment, whether the place of business or fixed establishment, the location of the establishment most directly concerned with the provisions of the supply; and

(d) in absence of such places, the location of the usual place of residence of the supplier;

2. Issues to be decided;

M/s Jaimin Engineering Private Limited is a company incorporated under the Companies Act 1956. lt is engaged in construction of cold storages at various parts of Country. They are expecting to do some construction work in the state of Rajasthan whereas they are located in the state of Gujarat and registered there in GST. As per GST provisions every supplier is required to take registration in each state where he have a place of business. Here they have place of business in Gujarat and are duly registered there. They will be charging IGST on their activity in Rajasthan making it a place of supply. The state share of that IGST will go to the state of Rajasthan as it is the place of supply. The taxpayer believes that he is not required to take registration in the state of Rajasthan.

3. Personal Hearing (PH)

In the matter personal hearing was given to the applicant. Ms. Shafaly Girdharwal , CA, Authorised Representative of applicant appeared for personal hearing on 25.06.2018. During the PH she reiterated the submission already made in the application for Advance Ruling. She requested that the case may be decided as per the submission made earlier in Application.

4. Findings and analysis:

The Works Contracts has been defined in Section 2(119) of the CGST Act, 2017 as “works contract” means a contract for building, construction, fabrication, completion, erection, installation, fitting out, improvement, modification, repair, maintenance, renovation, alteration or commissioning of any immovable property wherein transfer of property in goods (whether as goods or in some other form) is involved in the execution of such contract.”

As per Para 6 (a) of Schedule II to the CGST Act, 2017, works contracts as defined in section 2(119) of the CGST Act, 2017 shall be treated as a supply of services. Thus, there is a clear demarcation of a works contract as a supply of service under GST Act.

As per Section 2(15) of the Integrated Goods And Service Tax Act, 2017, the term

“location of the supplier of services” means,-

(a) where a supply is made from a place of business for which the registration has been obtained, the location of such place of business;

(b) where a supply is made from a place other than the place of business for which registration has been obtained (a fixed establishment elsewhere), the location of such fixed establishment;

(c) where a supply is made from more than one establishment, whether the place of business or fixed establishment, the location of the establishment most directly concerned with the provisions of the supply; and

(d) in absence of such places, the location of the usual place of residence of the supplier

The Location of the Works Contractor shall remain to be the state where his principal place of business is registered (unless he has established his office/ establishment in the place where the services are supplied)

As per section 12(3)(a) of IGST Act, 2017 in case of Works Contract Services Place of supply shall be the location at which the immovable property (construction site) is located.

Download the original order of GST AAR of Jaimin Engineering Pvt Ltd. By clickin g the below image:

Section 22(1) of CGST Act,2017 defines the liability for registration as:

Every supplier shall be liable to be registered under this Act in the State or Union territory, other than special category States, from where he makes a taxable supply of goods or services or both, if his aggregate turnover in a financial year exceeds twenty lakh rupees:

Provided that where such person makes taxable supplies of goods or services or both from any of the special category States, he shall be liable to be registered if his aggregate turnover in a financial year exceeds ten lakh rupees.

In view of the foregoing, we rule as under:

RULING:

A supplier of service will have to register at the location from where he makes Taxable supplies or is supplying Taxable services if his aggregate turnover in a financial year exceeds twenty lakh rupees (ten lakh rupees in any of special category states).

While supplying services if the supplier of services (i.e. applicant who in the given case is a Works Contractor and is registered in State of Gujarat) has any place of business/office in the State of Rajasthan i.e. has a fixed establishment for operation in State of Rajasthan (place where the services are to be provided) then he is required to get himself registered in State of Rajasthan.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.