GST AAR Case 4- Nash Industries (I) (P.) Ltd.

GST AAR Case 4- Nash Industries (I) (P.) Ltd.

GST AAR Case 4- Nash Industries (I) (P.) Ltd. an initiative by CA Arpit Haldia.

Query:

Whether the amortized cost of the tool has to be added to arrive at the value of the goods supplied under Section 15 of CGST Act.

Facts:

Customers of the applicant provide them with the drawings of the component. However, components being manufactured by applicant require specialized tools. Therefore, applicant designs and manufactures these specialized tools and bills them to the customer. The applicant, however, retains possession of the tools for the manufacture of components.

Observation:

AAR observed that the cost of tools is an essential element to be included in the cost of the component as components in question could not have been manufactured without these tools. The applicant could have procured these tools under three possible scenarios i.e.

a) Tools could have been manufactured by the applicant:-AAR Observed that applicant would not have incurred any cost under this scenario (AAR ignored the cost of Manufacturing of tools).

b) Tools could have been manufactured by a third party:

In case applicant would have procured tools from a third party, the applicant would have incurred a cost and such cost would have been included in the value of supply to the recipient.

c) The recipient could supply tools free of cost to the applicant:-

Applicant would not have incurred any cost as tools were supplied FOC by the customer.

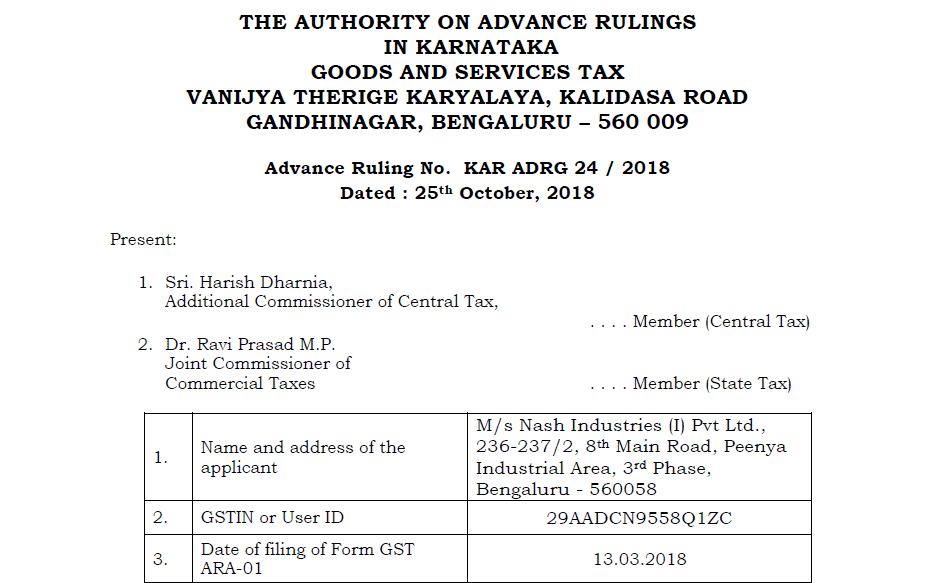

Download the order passed by AAR, Karnataka in GST Case 4- Nash Industries (I) (P.) Ltd. By Clicking the below image:

Held:

AAR held that in the instant case (Third Scenario) as applicable to the applicant, the cost of the tool has been borne by the recipient of supply whereas same should have been borne by the applicant. Therefore, the amortized cost of tools which are re-supplied back to the applicant free of cost by the customer shall be added to the value of components while calculating the value of components supplied as per Section 15 of CGST Act 2017.

Comments:

AAR seems to have passed over the proposition laid down by Circular No. 47/21/2018-GST dated 8th June 2018. AAR seems to have moved ahead with a preconceived notion that contract between applicant and customer was always for the supply of components using tools belonging to the applicant. If the cost of tools was not to be incurred by the applicant but by the customer then in such case, the amortized cost of tools is not required to be added to the value of supply.

CA Arpit Haldia

Send your queries at info@consultease.com