Extension of Form GST TRAN-1 for Exceptional cases

Extension of Form GST TRAN-1 for Exceptional cases

The order is issued by the CBIC regarding the extension of Form GST TRAN-1 to file. The date is extended up to 31st January 2019. There is the certain condition to avail such extension of the date. Only the person who has failed to file or submit the FORM GST TRAN-1 because of the technical error. Also, the person who has been recommended by the council for such extension.

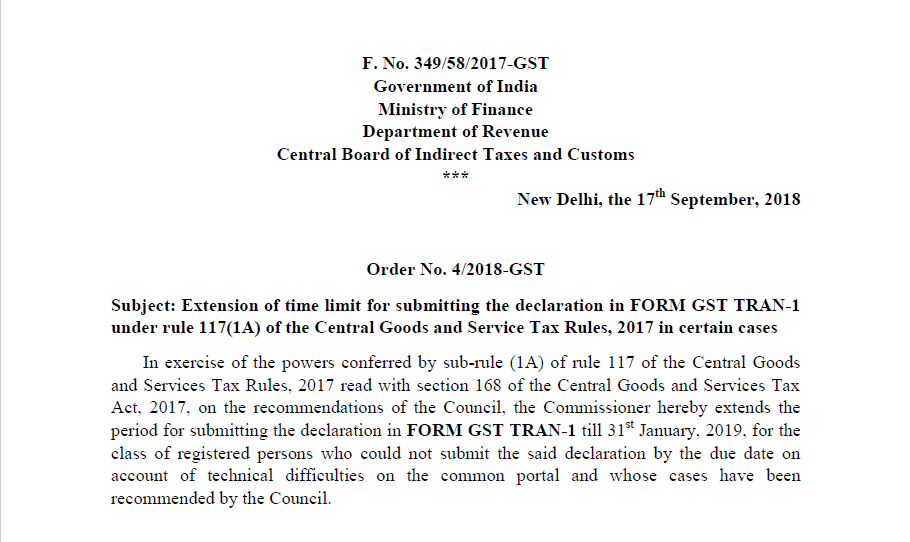

Following is the text of the order issued:

F. No. 349/58/2017-GST

Government of India

Ministry of Finance

Department of Revenue

Central Board of Indirect Taxes and Customs

New Delhi, the 17th September 2018

Order No. 4/2018-GST

Subject: Extension of time limit for submitting the declaration in FORM GST TRAN-1 under rule 117(1A) of the Central Goods and Service Tax Rules, 2017 in certain cases

In exercise of the powers conferred by sub-rule (1A) of rule 117 of the Central Goods and Services Tax Rules, 2017 read with section 168 of the Central Goods and Services Tax Act, 2017, on the recommendations of the Council, the Commissioner hereby extends the period for submitting the declaration in FORM GST TRAN-1 till 31st January, 2019, for the class of registered persons who could not submit the said declaration by the due date on account of technical difficulties on the common portal and whose cases have been recommended by the Council.

(Upender Gupta)

Commissioner (GST)

Download the Order No. 4/2018-GST by clicking the below image:

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.