Section-wise analysis of GST Amendments 2018

Section-wise analysis of GST Amendments 2018

This is related to the recent updates made in the GST act. In this, we will have done the section-wise analysis of GST Amendments 2018.

“Change is the law of life. And those who look only to the past or present are certain to miss the future.”

The above quote seems to be quite apt when it comes to couping up with the GST. With the advent of GST, various challenges had to be confronted by the trade and the government in the first fourteen months of GST. The frequent changes have not really been an astonishment exactly because of the nascent stage of the law. The upside to this has been the quick adaptability and responsiveness by the Government to the issues and concerns faced by the trade and industry as a whole.

Even though quite a few modifications were brought in through the rules and notifications, the major bottleneck had been the provisions in the GST Acts. For the first time after the enforcement of the law, the amendments in the Acts are on the cusp of being notified. The Lok Sabha passed the GST Amendment bills on 9th August 2018 and the same was given Presidential Assent to become an Act on 29th August 2018. Most of the provisions are soon to be effective once they are notified. So, it is of paramount significance that one should analyze the impact of these amendments diligently.

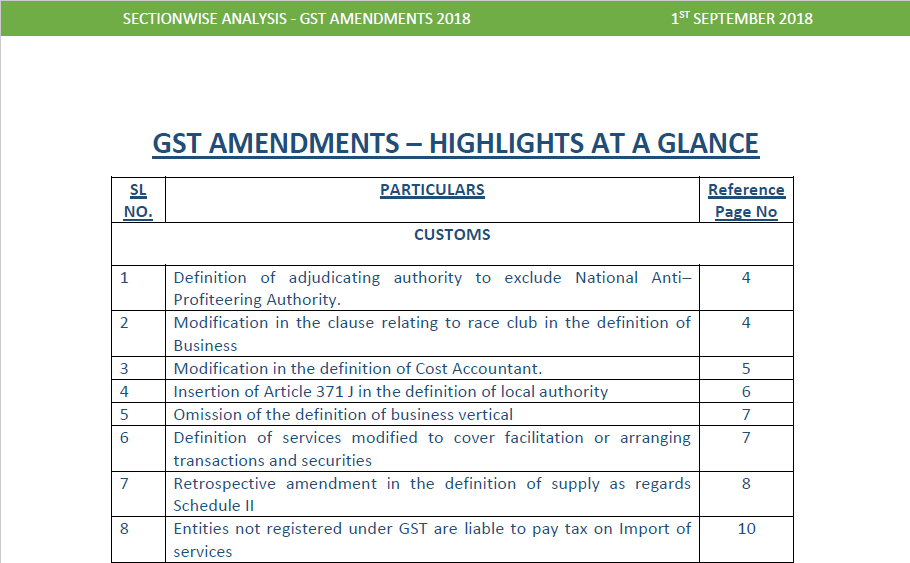

We have made an endeavor to collate all the amendments to the GST Acts together. On one hand, we have provided the highlights of the amendments at a glance and on the other, we have referenced the detailed analysis of each of these modifications.

We sincerely hope to provide you with the most reader-friendly approach to these amendments. However, if there are any suggestions, questions or comments relating to this material, feel free to the get in touch with us.

Download the full pdf. on Section-wise analysis of GST Amendments 2018 by clicking the below image:

Shubham Khaitan

Shubham Khaitan

Kolkata, India