PPt on GST Audit by CA Pradeep Modi

PPt on GST Audit by CA Pradeep Modi

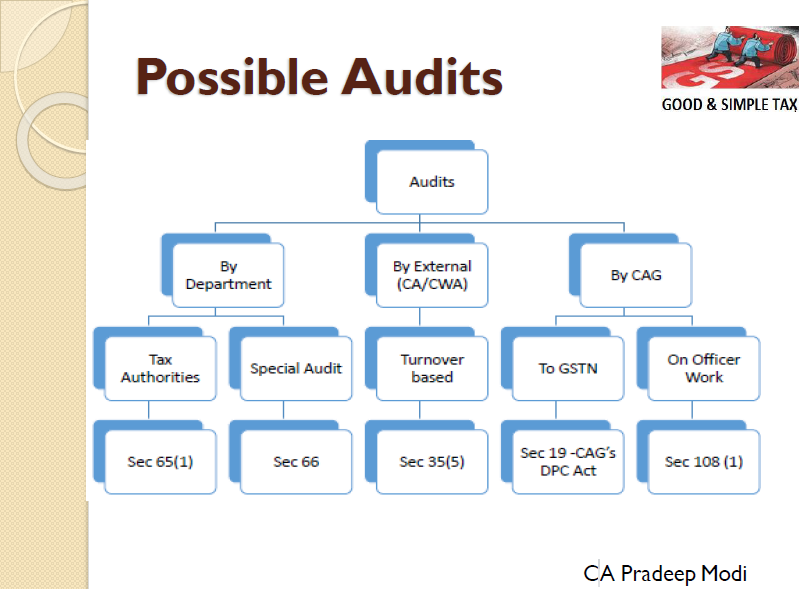

The explanation of GST Audit can’t be done very easily. Because of the liability which falls on the auditor. Every auditor will be liable for any wrong report and it may also result in penalty or Imprisonment or both. So, CA Pradeep Modi has brought us with the explanation and need for the GST Audit. All the provisions have been covered in the PPt on GST Audit by CA Pradeep Modi.

What is Audit

Examination of

- records,

- returns and

- other documents maintained or

- furnished by the taxable person

Under this Act or rules made thereunder any other law for the time being in force

To verify, interalia,

- The correctness of turnover declared,

- Taxes Paid

- Refund claimed and

- Input tax credit availed, and

To assess his compliance with the provisions of this Act or rules made thereunder.

Download the Full PPt on GST Audit by CA Pradeep Modi by clicking the below image:

Relevant Provision under CGST Act 2017 and CGST Rules:

Rule 80(3): Every registered person whose aggregate turnover during a financial year exceeds two crore rupees shall get his accounts audited as specified under sub-section (5) of section 35 and he shall furnish:

- a copy of audited annual accounts and

- a reconciliation statement, duly certified,

- in FORM GSTR-9C,

electronically through the common portal either directly or through a Facilitation Centre notified by the Commissioner.

Section 2(6): “aggregate turnover” means the aggregate value of

- all taxable supplies (excluding the value of inward supplies on which tax is payable by a person on a reverse charge basis),

- exempt supplies,

- exports of goods or services or both and [Includes Non-Taxable Supplies ?]

- inter-State supplies [Inter-state Stock Transfer ?]

of persons having the same Permanent Account Number,

to be computed on all India basis but excludes central tax, State tax, Union territory tax, integrated tax, and cess;

CA Pradeep Modi

CA Pradeep Modi

Kolkata, India