UAE VAT- Important Definitions and Meaning

UAE VAT- Important Definitions and Meaning

In the application of the provisions of this Decree-Law, the following words and expressions shall have the meanings assigned against each unless the context otherwise requires:

VAT (Value Added Tax)

VAT means a tax which is imposed on the supply of Goods and Services and Imports, at each stage of production and distribution, including Deemed Supply. VAT is a consumption tax which is imposed on all stages of value chain starting from production to distribution. As the name itself indicates, the tax would be levied on value addition in each of these stages till the goods or services reach the final consumer, means the entire burden of tax is to be borne by the ultimate consumer.

Goods and Services

In the context of UAE-VAT law, Goods means physical property that can be supplied including real estate, water, and all forms of energy as specified in the Executive Regulation of this Decree-Law. The definition of goods is very specific as it covers only physical property i.e. tangible goods. Few items have been specifically included in the definition of Goods i.e Real Estate, water and all the forms of energy.

Services mean anything that can be supplied other than Goods. It is relevant to observe that intangible properties which have been excluded from the definition of goods would get covered within the definition of services.

Imports and Importer

The arrival of Goods from abroad into the State (UAE) or receipt of Services from outside the State (UAE). Import of goods is when the goods are brought within the State from abroad which means not only from outside GCC countries but also from any of the GCC countries.

The person whose name is listed as importer on the date of import for Customs clearance purpose is defined as the importer under the VAT Law. Imports are taxable under VAT. When a person registered under VAT in UAE imports goods or services, the importer has to pay VAT on imports on the reverse charge basis. This is in addition to customs duty levied on imports with respect to Services, importer means the person who is Recipient of these Services.

Designated Zone

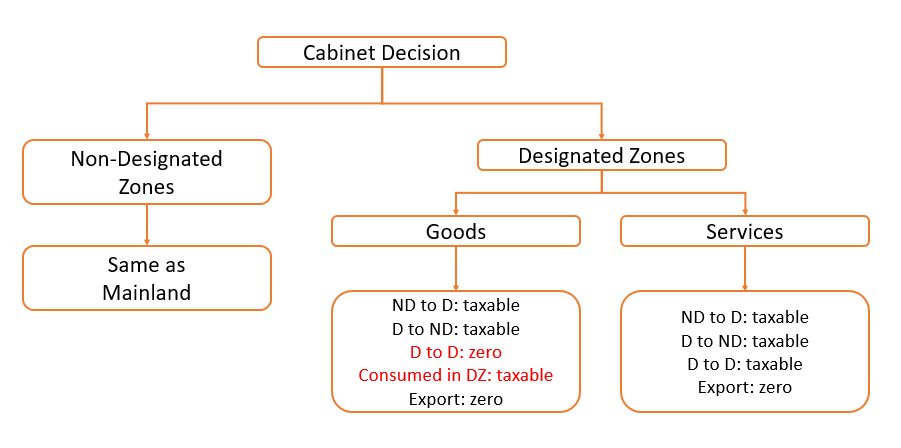

The designated zones (DZ) are special areas which are notified through Cabinet Decision No. (59) Of 2017 – As per the notification, there are 20 Designated Zones in the United Arab Emirates, which meet the conditions stipulated in the Executive Regulation of the Decree- Law. Designated zones are specified areas which shall be considered outside the GCC states. VAT shall not be applicable on transactions in designated zones, subject to some exception, while the areas other than designated zones shall be considered mainland for the VAT purposes.

According to the Executive regulations of the tax law, a designated Zone is a specific fenced geographic area and has security measures and Customs controls in place to monitor entry and exit of individuals and movement of goods to and from the area.

Additionally, a designated zone shall have internal procedures regarding the method of keeping, storing and processing of goods and the operator of the designated zone complies with the procedures set by the Federal Tax Authority (FTA).

Goods may also be transferred between Designated Zones without being subject to tax if the goods are not used or altered during the transfer process, and the transfer is undertaken in accordance with the rules for customs suspension per GCC Common Customs Law. The FTA may require a guarantee equivalent to the tax liability of the goods to be transferred in case the conditions for the transfer of goods between Designated Zones are not met.

Concerned Goods and Services

Concerned Goods mans those goods that have been imported, and would not be exempt if supplied in the State.

Concerned Services are those services that have been imported, where the place of supply is in the State, and would not be exempt if supplied in the State.

Exports

Movement of goods from the State to outside State to a person who’s Place of Establishment or Fixed Establishment is outside the State, including Direct and Indirect Export is considered an export of goods. Export of goods has further been classified into direct and indirect exports. The main difference between direct and indirect export of goods is that of the person responsible to carry on the transportation of goods, i.e. if the supplier is responsible, supply shall be treated direct export; whereas, if the customer is responsible for carrying on the transportation, it shall be treated as indirect exports.

Services are said to be exported when the recipient of services is located outside the State.

Consideration

All that is received or expected to be received for the supply of Goods or Services, whether in money or other acceptable forms of payment. It is also relevant that consideration includes not only what has been paid, but also which supplier may expect to receive in future. It is not necessary that the consideration should be in monetary form, it can be something which can be acceptable as a form of payment, which is generally seen in Barter system of exchange of Goods or Services.

Consideration should be in relation to supply of goods and services. Hence the refundable deposit would be not considered as Consideration; however, it is important to note the difference between refundable deposit and advance received in relation to goods and services. Advance received in relation to supply of goods and services could be considered as Consideration under UAE VAT law context.

Taxable, Exempt and Deemed Supply

Taxable Supply:

A supply can be considered as Taxable supply, only if it satisfies the below conditions:

(a) There should be “supply of goods” or “supply of service”, and

(b) Such supply should be for consideration, and

(c) The supply must have been made in the course of business, and

(d) The supply must have been made by a person in the State wherein he is conducting business, and

(e) It is not an Exempted supplies, however, zero-rated supplies (i.e. Supplies rated “ZERO” may be eligible to recover input tax) would be taxable supplies.

Exempted Supplies:

Important features of exempted supplies are:

(a) The supplies must be made in the course of business. Activity which is not in the course of business does not get covered within the definition of exempted supplies.

(b) There is no tax due on the supply.

(c) The supplier cannot recover the input tax paid on inward supplies of goods or services used for providing exempt supplies.

Meaning of Deemed Supply:

Anything considered as a supply and treated as a Taxable Supply according to the instances stipulated in this Decree-Law.

Place of Establishment

The place where a Business is legally established in a country pursuant to the decision of its establishment, or in which significant management decisions are taken and central management functions are conducted. This could be registered office, corporate office or any other place satisfying the criterions.

Fixed Establishment

Any fixed place of business, other than the Place of Establishment, in which the Person conducts his business regularly or permanently and were sufficient human and technology resources exist to enable the Person to supply or acquire Goods or Services. Not every temporary or interim location of a project site or transit-warehouse will become a fixed establishment of the taxable person. The following two elements are critical to determining whether a place is a ‘fixed establishment’:

- Having a sufficient degree of permanence; and

- Having a structure of human and technical resources.

Related Parties

Where two or more persons are not separable from each other on account of:

- Economic;

- Financial; or

- Regulatory level

And

One of them can control other/s either by:

- Law or

- Acquisition of (i) shares or (ii) voting rights.

Voucher

‘Voucher’, for the purposes of the VAT, means an instrument which gives its holder a right to receive goods or services against the value stated thereon. At the same time, it is an obligation for the holder to accept it as consideration (wholly or partly) for a supply. Therefore, a voucher is an asset for the recipient, and without a recipient, a ‘voucher’ would lose its meaning. Therefore, in the case of a supplier issuing a voucher to a recipient of goods, on his making a purchase from the supplier, the voucher is not being viewed as an additional outcome of the supply made to the recipient. Rather, it is an instrument that can be used in place of money (or other consideration) which can be used on affecting yet another inward supply. E.g. coupons, tokens, promo-codes, etc.

With technological advancement, the voucher need not necessarily be in physical form. It can be in digital forms also so long as it satisfies the essential attributes to claim right to receive goods or services or discount on their prices.

Capital Assets

Assets are defined under Cabinet Decision no.36 of 2017 on the ER of Federal Law No.7 of 2017(Tax Procedures) which provides the assets should be tangible and shall be owned, leased or used in connection with the conduct of business. Capital assets are defined in Article (57) of the Executive Regulation, as business assets which have estimated useful life equal to or longer than:

- 10 years in the case of a building or a part thereof.

- 5 years for all Capital Assets other than buildings or parts thereof.

The Federal Tax Authority was established under Federal Decree-Law No. (13) Of 2016. The Federal Tax Authority shall have jurisdiction over the administration, collection, and enforcement of Federal Taxes (including Value Added Tax) and Relevant Penalties. The Authority shall also be responsible to distribute their revenues and to apply the Tax Procedures applicable in the State. Federal Tax Authority shall have an independent legal personality, the necessary legal capacity to act and withhold financial and administrative independence.

The Authority’s Head Office shall be in the city of Abu Dhabi and it may, pursuant to a Board Decision, establish branches and offices inside the State. The Federal Tax Authority shall be managed by a board of directors chaired by the Minister and a sufficient number of members. The Board is the supreme authority overseeing the Authority’s affairs and conducting its business. The Authority shall have a Director-General at the rank of an Undersecretary.

Disclaimer

All rights reserved. No part of this Article may be reproduced, stored in a retrieval system, or transmitted, in any form, or by any means, electronic, mechanical, photocopying, recording, or otherwise without prior permission, in writing, from the author.

About Author

Author of this article is CA Deepak Bharti who is the member of ICAI. Currently, he is working as the partner in M/s NAV & Co. Chartered Accountants, handling the Corporate Compliance and Legal Department. He can be reached at cadeepakbharti@yahoo.com. Suggestions/comments are most welcome.

CA Deepak Bharti

CA Deepak Bharti

Delhi, India