Summary of IGST bill passed in parliament

IGST bill passed in parliament:

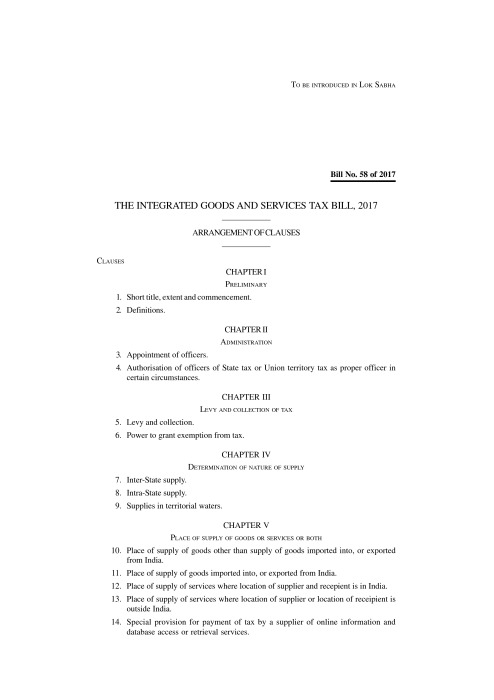

IGST bill is passed in parliament of India on 29th March 2017. You are now liable to pay IGST on all inter state and international supplies. IGST stands for the integrated Goods and services tax. For all intra state supplies CGST and SGST will be there. Once your supplies cross the state you become liable to pay IGST. This bill have

It contains nine chapters and nineteen sections.

Summary of IGST Bill:

|

Chapter in IGST bill |

Sections covered |

Provisions |

|

Chapter I |

Section 1&2 |

Preliminary |

|

Chapter II |

Section 3 & 4 |

Administration |

|

Chapter III |

Section 5 & 6 |

Levy and collection of tax |

|

Chapter IV |

Section 7 to 9 |

Determination Of Nature Of Supply |

|

Chapter V |

Section 10 to 14 |

Place Of Supply Of Goods Or Services Or Both |

|

Chapter VI |

Section 15 |

Refund Of Integrated Tax To International Tourist |

|

Chapter VII |

Section 16 |

Zero rated supply |

|

Chapter VIII |

Section 17 to 19 |

Apportionment Of Tax And Settlement Of Funds |

|

Chapter IX |

Section 20 to 25 |

Miscellaneous |

New section covering the refund of IGST to international tourist in introduced.

If you already have a premium membership, Sign In.

ConsultEase Administrator

ConsultEase Administrator

Consultant

Faridabad, India

As a Consultease Administrator, I'm responsible for the smooth administration of our portal. Reach out to me in case you need help.