AAR ruling fuels fears of double GST

AAR ruling fuels fears of double GST

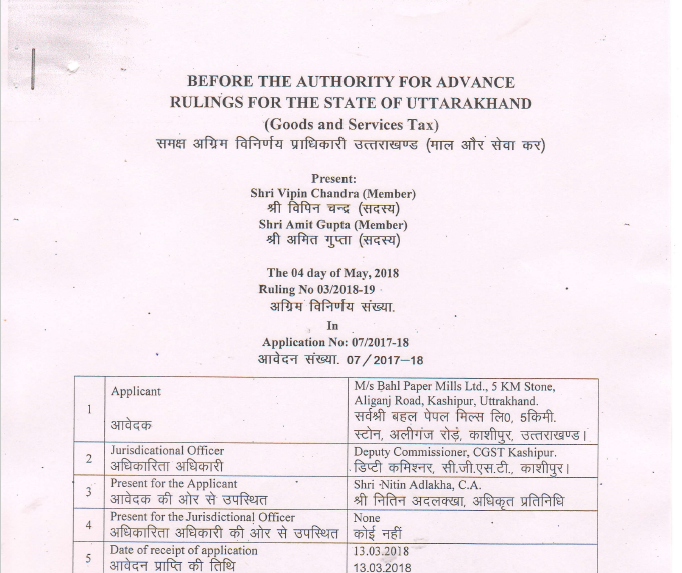

An order by the Authority for Advance Rulings (AAR) has sparked fears of double taxation under the goods and services tax (GST) for goods imported on the basis of cost, insurance and freight (CIF).

The AAR, Uttarakhand, has ruled that the importer will have to pay the integrated GST (IGST) on CIF value and also on the ocean freight component. The issue before the AAR was whether the importer will have to pay the IGST on freight value, on the reverse charge mechanism (RCM), when the service provider and service recipient are outside India.

Click the image to download the full AR:

Generally, the service provider has to submit the GST to the government, but under the RCM the buyer will have to do it. Experts say this amounts to double taxation since the importer pays the IGST on CIF value.

While companies importing goods under the GST get input tax credit, those importing other goods such as crude oil may not get refunds and hence their cost will increase, said Abhishek Jain, partner, EY India. The same issue is pending before various other courts. Even the constitutional validity of these provisions of the GST is being challenged.

Get unlimited unrestricted access to thousands of insightful content at ConsultEase.

If you already have a premium membership, Sign In.

payu form placeholder

If you already have a premium membership, Sign In.

CA Shafaly Girdharwal

CA Shafaly Girdharwal

CA

New Delhi, India

CA Shaifaly Girdharwal is a GST consultant, Author, Trainer and a famous You tuber. She has taken many seminars on various topics of GST. She is Partner at Ashu Dalmia & Associates and heading the Indirect Tax department. She has authored a book on GST published by Taxmann.